Livestream e-commerce to continue reaping benefits in China

Large consumer market, digital payment pull China ahead for interactive e-commerce

Viya introduces products during a livestream show in April. Photos: VCG

When America's top influencer Kim Kardashian saw how fast popular Chinese livestreamer Viya sold 1,5000 bottles of perfume in 2019, the gap between the Chinese and US livestreaming e-commerce industry was brought into sharp relief.

The coronavirus outbreak pushed many Chinese to buy daily necessities online last year and some have developed the habit of shopping online via watching top livestreamers' market products, Viya told the Global Times in a recent group interview.

When some raised doubts that selling goods via livestream may bounce off the ceiling in China after years of rapid growth and some are concerned about China's sluggish consumption in post COVID-19 era, the powerful Chinese livestreamer refuted such claim and said her number of fans is still increasing steadily.

Thanks to the robust digital economy, mature logistics and convenient online payment practice, China's livestream e-commerce industry has taken a lead worldwide and will continue to reap benefits in the future, Zhang Yi, CEO of a mobile internet consulting agency iiMedia Research, told the Global Times on Monday.

Taking the lead

Before the kickoff of a Friday gala in Hangzhou, capital of East China's Zhejiang Province, the 34-year-old livestreamer, who has banked 300 million yuan ($46.8 million) sales revenue in just one day, shared her thoughts on how technology could empower the industry in China.

"With the increasing popularity of 5G technology and the emerging uses of virtual reality (VR) and augmented reality, is it possible that someday, a robot could livestream for us? Is it possible if I put on VR glasses, I could see how do I look in an item of clothing that I want to buy?" Viya said.

The gala, which was the fifth one since it was initiated, was a celebration for Viya's fans. Before China's mid-year online shopping spree - the 618 online shopping festival which falls around June 18, Viya had issued digital red packets worth of 100 million yuan to livestream users at the gala, where multiple Chinese singers and pop stars performed during the event.

The popular online influencer now has more than 79.88 million followers on Taobao livestream platform and about 110 million viewership were recorded just on Monday's livestream.

"Discounts are the biggest attraction to me during livestream. The gifts provided are also abundant which I could not enjoy at offline shops," a 25-year-old white-collar worker in Beijing who often watches Viya's livestream shows told the Global Times.

But she added the long-time livestream has a disadvantage as "you have to wait in front of the screen until the products you want to buy show up."

As of April, 90 percent of the consumers are willing to choose wholesale e-commerce, according to iiMedia Research. "Consumers generally believe that the prices of goods on wholesale e-commerce are lower and there are more kinds of goods, and 96 percent of them prefer to shop on livestream e-commerce."

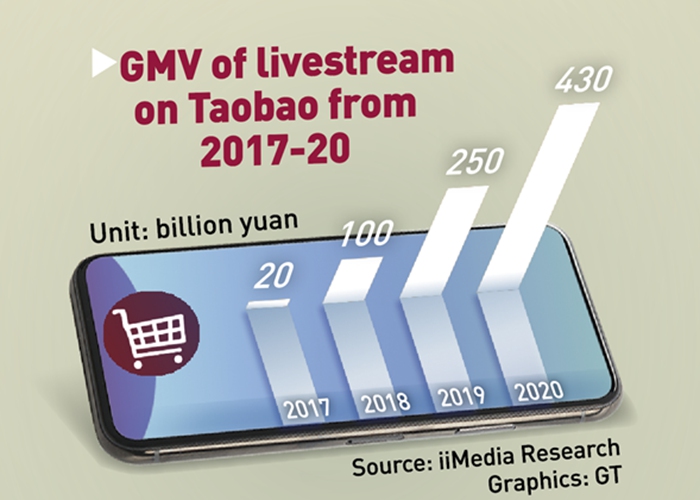

Graphics: GT

Market benchmark

Livestream e-commerce was born in China. Now, some countries and brands have seen the benefits in this new sales format and are eager to give it a try.

Last December, Walmart cooperated with TikTok and initiated the first livestream sales event. Though they did not reveal the sales results during the one-hour event, it recorded nearly 20,000 views.

The discrepancy in the industry between the Chinese and overseas markets is directly related to the number of online buyers, economical products and in-depth analysis of user behaviors, analysts said.

Online shopping requires sophisticated infrastructure supports, including the digital-empowered financial system and logistics system, in which the current e-commerce US market still lags behind China, Zhang noted.

"One of the features of China's livestream e-commerce industry is the large number of consumers online which could realize free flow of logistics and capital," he said.

Another factor which may limit foreign companies, like Amazon's livestream sector, is the lack of competitive pricing as most of the products on the platform sold during livestream shows are manufactured in developing countries, meaning consumers are unlikely to snap up good at significantly cheaper prices, according to Zhang.

The last but not least, the convenience and maturity of digital payment facilitate China's livestream e-commerce. "According to our research, scanning to pay improves the efficiency by threefold than that of using credit card; and face-scanning payment doubles the efficiency of scanning to pay," the expert added.

According to the statistics by iiMedia Research, the market size for livestream e-commerce in China reached 961 billion yuan. The achievement comes as China's total retail sales declined amid the coronavirus epidemic last year.

China's retail sales dropped 3.9 percent year-on-year to 39.20 trillion yuan in 2020 amid the COVID-19 outbreak.

By comparison, data from Coresight, a global advisory and research firm, showed the US livestream market is expected to reach $11 billion by 2021 and hit $25 billion by 2023 as it plays catch-up to China.