What’s next for China-US after phase-one trade deal?

As China strives to fulfill commitments, US set up roadblocks along the way

China-US relationship. Illustration: Liu Rui/Global Times

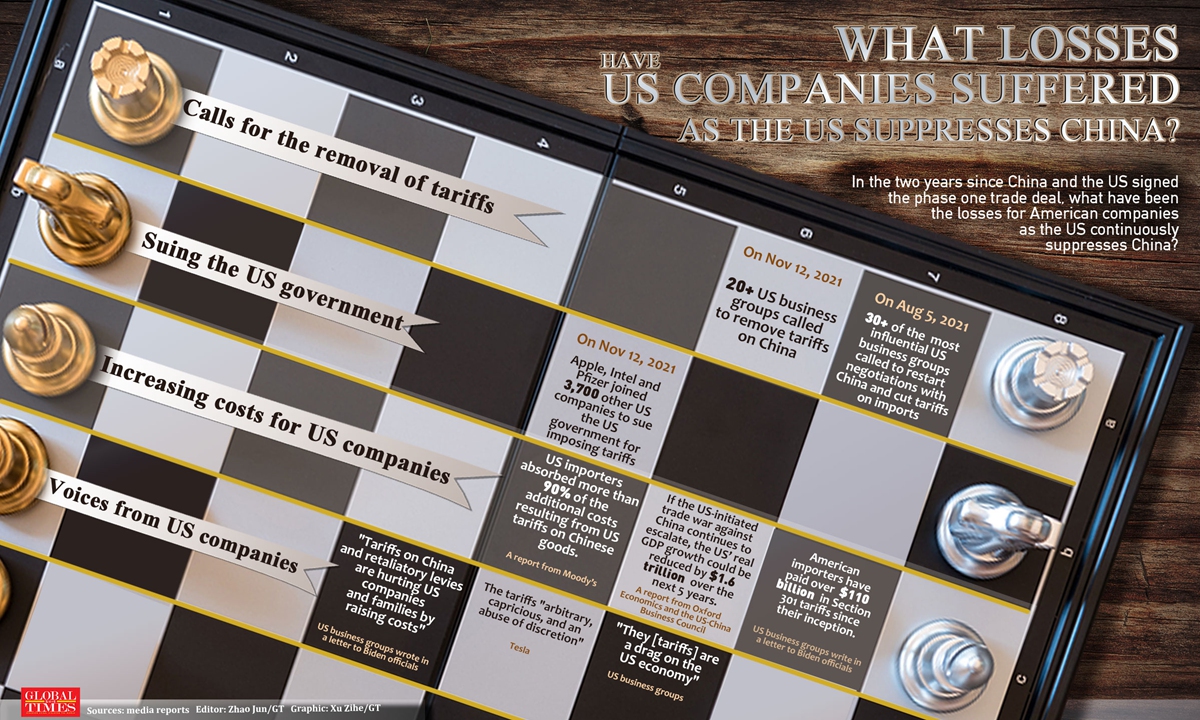

What losses have US companies suffered as the US suppresses China? Infographic: Xu Zihe

Over the past two years, while China has been facing all kinds of headwinds to fulfill the promises it made in the hard-won deal and striving to bring some certainty to a battered global economy, the US has never stopped setting up roadblocks on a path that could have steered the two countries' relations back on track.

With the two-year period coming to a close, some US media outlets and think tanks have again started picking faults with the deal, and in particular putting blame on China's purchase of US products, dismissing the US' treachery and its failure in maintaining its manufacturing ability under the shadow of the COVID-19 pandemic.

"There is no doubt that China has been overcoming all kinds of difficulties amid the coronavirus woes and has done its best to implement the agreement. If there's anyone to blame, that would be the US," Gao Lingyun, an expert at the Chinese Academy of Social Sciences in Beijing, told the Global Times on Thursday.

Gao cautioned that a review of the deal has to go both ways. Before the US side tries to carry out the so-called review of China's performance in the deal, it also needs to ask itself how many roadblocks it has set up along the way while China was trying to fulfill its commitments, and some major circumstances, such as the pandemic, must also be kept in mind.

Taking soybeans as an example, Zhang Xiaoping, country director for China at the US Soybean Export Council (USSEC), told the Global Times that China's purchase volume of soybeans was lower than the industry's expectations in 2021, but the reasons he listed - including the US' low inventories last season, the disruption to the US South Bay export terminal due to the hurricane at the end of August, and a congested Panama Canal - were not the fault of China.

According to Zhang, in the 2021 calendar year, the amount of soybeans that China purchased and shipped from the US was estimated to be about 27 million tons, about 8 million tons less than the figure in 2020. But from the perspective of the value of soybean exports, due to higher prices in 2021, both years saw a revenue of more than $14 billion.

Moreover, US' tariffs on Chinese products, a series of strengthened sanctions on more Chinese firms ranging from tech giant Huawei to the emerging AI firm SenseTime, and its smear campaign against China during the pandemic - all of which hindered the smooth implementation of the deal.

Key takeaways of the phase-one deal include China's pledge to buy at least $200 billion more in US goods and services over 2020 and 2021. In addition to goods and services purchases, the phase-one deal also included broad provisions for China to strengthen intellectual property (IP) protection and open its markets to financial services firms.

On China's side, even with disruptive factors such as a raging COVID-19 pandemic, which has blocked transportation and disrupted the global supply chain, China still managed to meet about 62 percent of that target as of October 2021, according to calculations by the Washington-based Peterson Institute for International Economics.

It's also worth noting that no official data, from either China or the US side, has been released to measure China's purchases so far.

Intensifying competition

With the phase-one trade deal expiring, what's next for the world's two largest economies' already intense relationship has now become the focus of discussion.

Gao expected a high-level meeting to be held later to review the two-year trade agreement, with China's core claims being the reduction of tariffs and asking the US to stop imposing unreasonable sanctions against Chinese firms.

"Washington has to show some sincerity during the upcoming talks before it expects any more progress," Gao said.

With the new Regional Comprehensive Economic Partnership, or RCEP, officially going into effect on January 1, 2022, a more diverse range of trade partners and integrated Asia-Pacific industrial chain will offer China more leverage in its future trade talks with the US, analysts said.

The path ahead still remains unclear, but it's now becoming a common consensus that competition between the world's two largest economies has just started, and will become more intense in the next decade and beyond.

The competition between the US and China is not a "modern boxing match" but is more like a "race," and the rivalry should not be perceived as one side beating the other to the ground, said Chinese Ambassador to the US Qin Gang during a joint interview with chief editors and senior correspondents of major American media outlets, read a statement on Chinese Embassy in US on December 24.

Meanwhile, both sides can also seek opportunities for cooperation during competition, so that they can make themselves stronger while allowing the other side to grow and develop, Qin said, noting that the competition should be held in a fair and healthy manner.

"A complete trade decoupling is impossible, but we should try to prevent and prepare for a decoupling in certain areas, most likely in high-tech sectors, since there are signs that the US is building a higher and higher 'wall' between the two sides' technology sectors," Gao said.

The US crackdown on China's technology sector has been expanded from 5G to AI and biotechnology, in a desperate effort to maintain its shaky tech dominance. In mid-December, the US Department of Treasury added SenseTime, one of China's most valuable AI solution providers, to a list of "Chinese military-industrial complex companies," barring US investors from purchasing or selling publicly traded securities of the firm.

The US Commerce Department also announced recently that it will place export restrictions, for national security reasons, on several Chinese companies that use biotechnology and other technologies, and also for reasons including what it claimed were their roles in "helping the Chinese military" and alleged "human rights abuses against ethnic and religious minority groups."

Twists and turns might continue in the future, but the trade volume between the two countries will continue to rise in 2022, and even surpass the already high level in 2021, He Weiwen, a former senior trade official and a senior fellow of the Chongyang Institute for Financial Studies at the Renmin University of China, told the Global Times on Thursday.

The total trade value between China and the US hit $682.32 billion from January to November in 2021, a year-on-year increase of 30.2 percent, Chinese customs data showed. China also maintains its position as the second-largest trading partner of the US after the European Union, even with tariffs aimed at weakening China's export advantages still in place.

In terms of direct investment, according to statistics released by the US Bureau of Economic Analysis (BEA), in the first half of 2021, the net outflow of US direct investment in China was $390 million, a year-on-year increase of 69.5 percent. The net outflow of Chinese direct investment in the US was $3.558 billion, down by 38.7 percent due to the US' repeated abuse of the national security concept to suppress Chinese firms.

Trade can still be a buffer in the China-US relations, which is the common wish of both China and the US business communities and their people, He Weiwen said, noting that China will firmly safeguard its interests, oppose the unilateral approach, and resolutely promote cooperation between local people and enterprises in the two countries.

Wang Cong contributes to the story