Global firms to take advantage of $172.9b winter sports market, boosted by Beijing Games

A worker finishes the main snow sculpture featuring Beijing 2022 mascots at the 34th Harbin Sun Island International Snow Sculpture Art Exposition in Harbin, northeast China's Heilongjiang Province, Dec. 27, 2021. (Xinhua/Wang Jianwei)

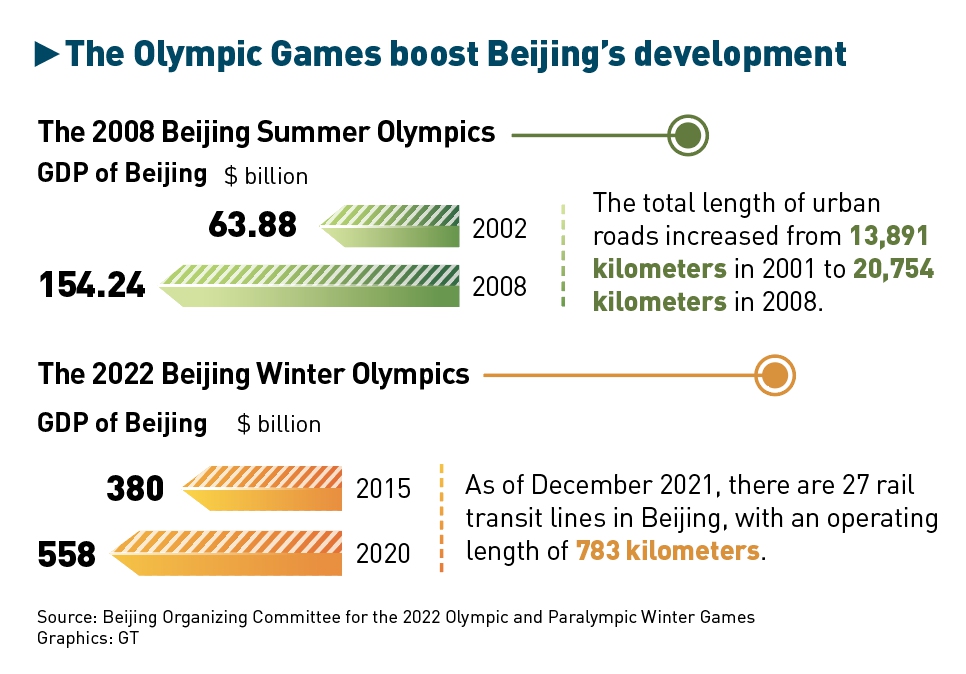

More than a decade from the Beijing 2008 Olympic Games, a massive boost to the then-US subprime crisis-hit global economy, the world has much to expect from the Beijing Winter Olympics as the global economy is headed for a pronounced downturn amid woes over COVID-19 variants, rising inflation and various uncertainties.

Hosting the Winter Olympics as planned, regardless of economic downturn pressures and sporadic flare-ups of Omicron and Delta variants is no easy feat, observers said.

Graphic:GT

As Beijing is ready to deliver what officials are calling a simple, safe and splendid Winter Olympics, the global economy is facing mounting challenges brought about by a COVID-19 pandemic entering its third year. In its latest forecast on Tuesday, the IMF said global growth will slow to 4.4 percent in 2022 and 3.8 percent in 2023, warning "multiple challenges" ranging from supply disruptions, heightened inflation, record debt and economic uncertainty.

Once again, the world economy is in dire need of solutions and global cooperation - and a silver lining that could guide the world out of a dark period. And the Beijing Winter Olympics, beyond what could be another astonishing show of athletic excellence and human spirit, might offer such a silver lining for the global economy, according to businesses and economists.

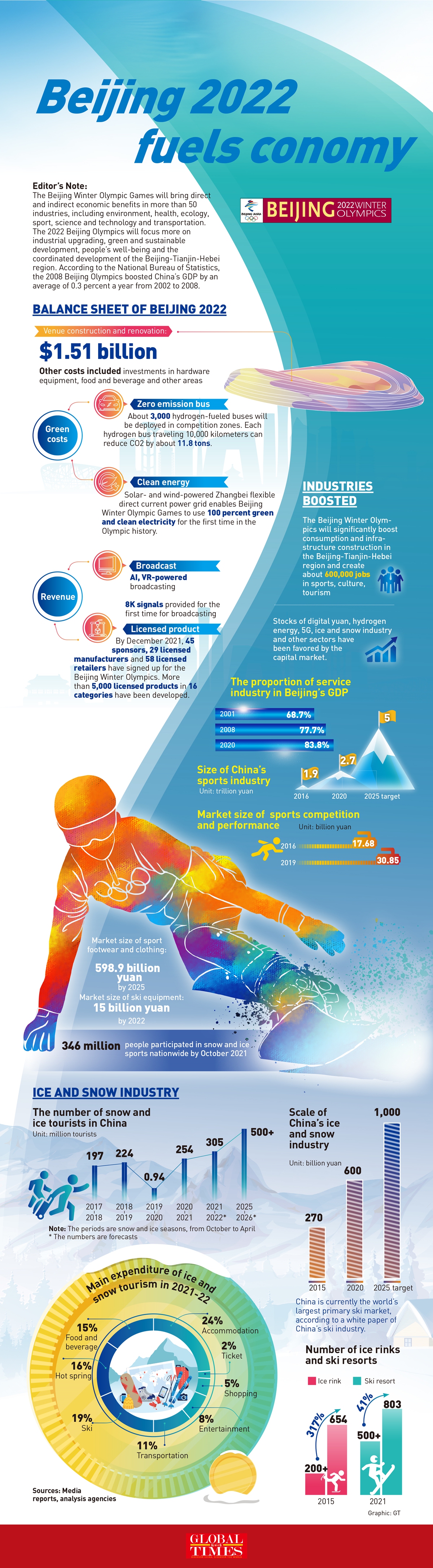

Thanks to the multi-year nationwide promotion of winter sports ahead of the Olympics, China has seen a robust growth in the ice and snow tourism market, which is expected to generate revenue of over 1.1 trillion yuan ($172.9 billion) by 2025, with the number of tourist trips expected to exceed 500 million, according to an industry report. China is aiming to engage 300 million people in winter sports, a majority of whom will spend at venues and resorts, in addition to buying equipment and apparel.

What Winter Olympics unleash is massive, untapped opportunities in a wide range of areas from infrastructure to services to technology to green development. At the Beijing Winter Olympics, environment-friendly venues, state-of-the-art high-speed rail and advanced technologies point to the remarkable progress and future direction of sustainable development throughout the world's second-largest economy, where a relentless push for green and sustainable development has already provided huge opportunities for companies from around the world.

The mascots for the Beijing Winter Olympic and Paralympic Games are seen on a street in Beijing on January 11, 2022. Photo: VCG

'Major silver lining'

The Winter Olympics go beyond a mega sports event that's intended to boost the winter sports economy, Tian Yun, former vice director of the Beijing Economic Operation Association, told the Global Times.

Viewing the event as a ray of hope amid the pandemic, Tian said that the country would showcase its unrivaled strength in hosting the Olympic Games despite a mix of Omicron and Delta variants, flaming optimism through the global economy that China, a main growth engine, remains a hotspot for global partnerships.

With the visionary winter event blazing the Olympiad trail, ice and snow experiences that are yet to be opened to the general public, a game changing moment is around the corner.

Xu Xingfeng, an official with the Ministry of Commerce, told reporters in late January that there's a consumption boom unfolding in China's winter sports industry as the Beijing Winter Olympics approach.

Xu cited various ski-and-snow consumption activities being rolled out in Beijing, Shanghai, Jilin, Heilongjiang and Hubei provinces, on the premise of effective virus containment, with ski equipment sales doubling on some e-commerce platforms.

The size of China's ice-and-snow industry, ranging from equipment suppliers, ski resort development firms and tourism businesses, to distributors of ski and snow items, is forecast to expand to over 800 billion yuan in 2022, Chen Mengjie, chief strategist with Yuekai Securities in Beijing, told the Global Times, citing government policy plans.

Ski and snow tourism revenues saw a notable decline in 2019-20 due to the impact of the virus, but it's predicted to gradually rebound thanks to the tailwinds created by the Winter Olympics and the country's effective COVID-19 containment, according to Chen.

The number of skiers in China as a percentage of its population stood at modest 1 percent in 2019, far below countries with a significant head start such as Switzerland that boasts a 35 percent penetration rate, she continued, speaking of vast untapped opportunities in the wake of the Winter Games.

With the growing popularity of winter sports in China, revenue of ice and snow tourism will reach 1.1 trillion yuan by the end of 2025, a remarkable jump from 386 billion yuan in 2019, with the number of tourists doubling from the 2019 figure of 224 million in 2025, according to the China Tourism Academy.

Sarah Lewis, while running for the presidency of the International Ski Federation (FIS), the world's largest winter sports governing body, in April 2021, told Xinhua in an interview that "alongside the performance programs, the regions and cities around China are part of the project to develop winter sports as a recreational activity for the health and welfare of the population and for tourism."

"When you consider the global snow sports market has 150 million participants, tripling it will have a major impact on the winter sports industry - not only in China, but around the world," according to Lewis.

The massive growth potential is the direct result of the Chinese government's nationwide promotion of winter sports. After Beijing won the bid to host the 2022 Winter Olympics, China has not only rolled out a range of development plans, including the development plan for ice and snow sports (2016-25), but also made huge investment in not just traditional infrastructure but also sustainable development - a priority for the Olympics as well as for China.

Graphic:GT

Sustainable development

The Beijing Winter Olympics, the greenest gathering in the history of Olympic Games, are by no means an extravagant event, unlike many of its predecessors, even though its repercussions seem rather profound, analysts said, citing an estimated surge in ice and snow experiences.

Back in 2018, when the International Olympic Committee unveiled a new package of reforms to overhaul the Olympic bidding process, with a set of 118 reforms devised to cut the Games' delivery expenditures for candidate cities, the Beijing Winter Olympics were envisaged to set a new benchmark in delivering the event in a cost efficient manner.

The budget for the 2022 event was projected at $1.56 billion, with 6 percent subsidized by the government, and a further $1.51 billion in infrastructure upgrade outlays with 65 percent coming from social investment, local media reported, citing Beijing's bid committee.

With the 2008 summer Olympics leaving a rich legacy, China has reused multiple existing venues, including the iconic Bird's Nest stadium and the Ice Cube, formerly known as the Water Cube, successfully avoiding the risk of these facilities being left idle after the Games.

By comparison, the 2018 PyeongChang Winter Olympics cost about $13 billion while the Sochi Games came in at $50 billion, according to media reports.

The Beijing Winter Games are also supposed to add expenditures on measures to prevent the coronavirus spread. Such measures accounted for 3 percent of the total cost of Tokyo Summer Olympics last year, according to Guoyuan Securities.

The estimated official costs of the Tokyo Olympics were purportedly $13.6 billion.

That said, the Beijing Winter Games, on a much tighter budget, would remain a boost for the country's infrastructure upgrade, especially in smart and renewable projects, while also ramping up ice and snow experiences across the country, according to publicly available information and analyst estimates.

In early January, the first train customized for the Beijing Winter Olympics set off on the high-speed rail connecting Beijing and Zhangjiakou, the co-host cities of the Winter Games.

The newly unveiled Fuxing bullet train, with a 5G livestreaming studio on board, is reputed to be the first-of-its-kind intelligent and autonomous high-speed train with a maximum speed of 350 kilometers per hour.

The low-carbon edition of the Olympiad is also set to be the first Olympic Games with all venues entirely powered by clean energy, enabled by a 500-kilovolt flexible and direct-current power grid in Zhangjiakou's Zhangbei that transmits wind and solar power-generated electricity.

The focus on sustainability at the Winter Olympics will also offer a boost for a series of China's long-term sustainable development goals, including infrastructure upgrades, especially in smart and renewable projects, high-end consumption market, rural revitalization, technological innovation and environmental protection - all are set to unleash opportunities for domestic and global companies in the long run.

Shougang Ski Jumping Platform Photo: IC

Enticing icing for all

The mega opportunity enabler has already turned out to be a growth accelerator for dozens of domestic listed firms and the foreign business community is also eager to capitalize on China's winter sports boom.

Among those muscling in on the Olympics fortune are manufacturers and retailers of licensed merchandise and sponsors. Over the past four years, licensed merchandise that have been designed and produced has headed north of 5,000 products across 16 categories. Additionally, over 190 licensed merchandise retail outlets have opened across the country, Xinhua reported in mid-January, citing the Beijing Organizing Committee for the Olympic and Paralympic Winter Games.

Further, the Beijing Games that rolled out its marketing program in 2017 have inked a total of 45 sponsors, per a Xinhua report in December. In a sign of the eagerness of sponsors, the actualized sponsorship incomes from the Beijing Winter Olympics' marketing program have outnumbered all previous winter games.

Notably, the event represents a boost for both domestic and foreign businesses that are eager to expand in the vast Chinese market.

A typical example of intense foreign interest in the Winter Olympics is Italy-based TechnoAlpin, a snowmaking equipment giant with a 60 percent share of the global market.

The company, which has served six of the last eight winter games, set up its Chinese subsidiary in Sanhe, North China's Hebei Province in February 2014 before settling in the Zhangjiakou Ice and Snow Sports Equipment Industrial Park in July 2018.

TechnoAlpin is also providing snowmaking equipment and automation systems for the Beijing Winter Games.

"We have benefited enormously from the 2022 Olympic Games," Pierpaolo Salusso, general manager of the Italian firm's Zhangjiakou offshoot, said less than a month from the Games' opening ceremony, according to Xinhua.

Beijing 2022 Winter Olympic Games fuels economy Infographic: GT