Bitcoin golden physical coin illustration on United States Dollar banknotes. Photo: AFP

US President Joe Biden on Wednesday signed an executive order instructing the federal government to explore regulatory oversight of digital assets like cryptocurrencies and requiring research and development efforts into a potential "US Central Bank Digital Currency (CBDC)", AP reported.

It was not long ago that the US Federal Reserve remained hesitant toward whether it was necessary to launch an official digital currency pegged to the US dollar. But concerns that Russia might use cryptocurrencies to evade sanctions the US imposed on its financial system appear to have given the Biden administration enough motivation to take a decisive step toward a government-backed digital currency.

With technological development advancing quickly, it has become a general trend for global currencies to embrace digitalization. Over the years, cryptocurrencies such as bitcoin have caused much turmoil across financial markets, prompting warnings from government officials and experts around the world about their high volatility and trading risk. This is the background and one of the reasons why central banks from Europe to Asia are stepping up work on researching and developing their own digital currencies, namely, to reduce financial risks surrounding digital currencies.

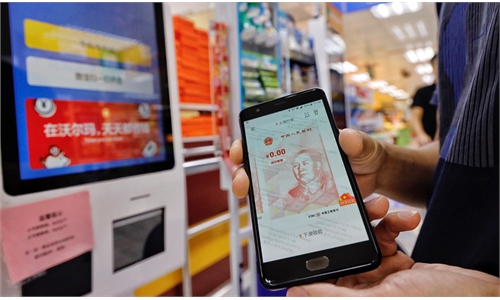

China has become a front-runner in developing a digital version of the Chinese yuan, with large-scale trials of the digital yuan already rolled out in many scenarios over the years. But as competition between the US and China intensified, the latter's digital yuan development has fueled some speculation that the digital yuan could pose a challenge to or end the dollar's hegemony. Even though China has been accelerating and steadily developing its digital yuan, which is believed to offer a boost to the yuan's internationalization, the exaggeration of the progress made in internationalizing the Chinese yuan is misleading and will only create unnecessary pressure and hostility.

While the emergence of digital currencies could pose competition against the dollar one day, it may not necessarily undermine the US dominance in the world financial system. If anything, the dollar makes up a significant part of global foreign exchange reserves, and the majority of the world trade is still settled in the dollar.

If the US dollar's dominance in the global trade settlement is threatened or weakened, the source of that destructive factor can only be tracked down to the US government's abuse of its financial power that drives other countries to seek alternatives for the purpose of their own financial security. In fact, this is exactly what's happening when the US imposed unilateral financial sanctions on Russia.

The global economic development has reached a point when the US does not have the overwhelming advantages in global trade and many other fronts. It justifies why the US needs to step up research and development efforts in emerging areas such as digital currency, but it doesn't necessarily mean that it can extend its dollar hegemony to the digital currency area.

Fundamentally speaking, it is not a bad thing for the US to join the digital currency race, which may allow the US to strengthen cooperation with other countries when it comes to government supervision over digital assets. But if the US' interest in the research and development of government-backed digital currency is aimed at countering or sanctioning others, market risks will only exacerbate, which is detrimental to the dollar's status.