Illustration: Chen Xia/Global Times

With Shanghai, China's largest industrial city, largely locked down to smother a severe coronavirus outbreak, and a dozen other Chinese cities have all stepped up their pandemic restrictive measures, the country needs to hit the gas pedal by vigorously investing in domestic infrastructure projects to accelerate economic growth in 2022.To accompany the infrastructure agenda, the government ought to also ratchet up stimulus spending through implementing a set of more proactive fiscal and monetary policies over coming months. If warranted, provinces and cities in China should consider issuing coupons to boost retail sales and domestic consumption across Chinese households, including promoting sales of big-items like electric vehicles among urbanities, and panel television sets, washing machines and refrigerators in rural regions.

And, the government is obliged to deploy more accommodative policies to inspire rapid development of urban real estate sector, and a faster growth of all-important internet platforms. The two sectors significantly cooled down in 2021 as the regulators tightened anti-monopoly scrutiny and moved to reduce the debt levels of the property developers. Now some Chinese cities have worked out more preferential policies to facilitate housing sales, with local lenders allowed to reduce the down payments, while trim interest rates for mortgages.

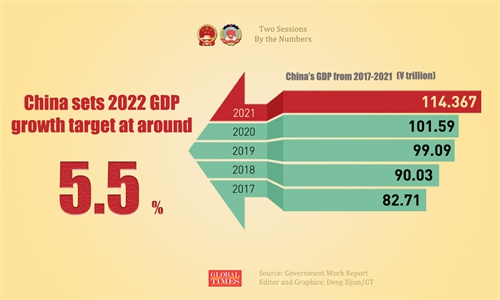

It is becoming an increasingly arduous job for China to realize its projected GDP (gross domestic product) growth rate of around 5.5 percent set for 2022, which was planned and approved by the National People's Congress (NPC), the top legislature, in earlier March.

The country needs a relatively faster economic growth rate to provide sufficient employment opportunities for tens of millions of Chinese workers and new college graduates to maintain social stability. Also, continued expansion of the economy is needed to lift China toward its goal of becoming a fairly affluent society in the world and keep a larger distance from the so-called "middle income trap". China's per capita GDP surpassed $12,500 in 2021.

The challenges facing the world's second largest economy are increasing as millions of people are isolating in Shanghai, the northeastern auto city of Changchun, and a few other smaller cities being shut down to stifle the latest flare-up of the rapidly transmissible Omicron variant. Meanwhile, a prolonged property sector slump and sluggish consumption recovery are weighing on the economy, adding urgency for the top policymakers to step up efforts to bolster economic growth.

A gauge of services sector activity in the country published last week plunged to its lowest level since early 2020, because many localities in China imposed strict anti-coronavirus restrictions that prevented people from moving around and seriously impacted consumer spending. The Caixin and IHS Markit China services purchasing managers index dropped to 42.0 in March from 50.2 in February, readings below 50 indicates activity is contracting rather than expanding.

The Shanghai lockdown is particularly concerning as the city acts as one of the leading drivers of China's $18 trillion giant economy. Coronavirus infections have kept growing with a total caseload which has now topped 170,000 during the latest wave of Omicron outbreak, making Shanghai the worst hit city in China's mainland since 2020. Some factories and companies have employed closed-loop management with the workers sleeping on factory floors to maintain production and ensure crucial industrial supply chains do not grind to a halt.

To help combat and contain the outbreak, the central authorities have moved more than 40,000 medical workers from other provinces and the People's Liberation Army to assist Shanghai. However, the country remains anxious over how long the city will be able to effectively control the epidemic by cutting off community infections and ending the lockdown so that everything could come back to normal and factories could operate at their full capacity.

Shanghai, at current stage, should continue to rely on mass testing and aggressive contact tracing to identify all hidden infections and put their close contacts under quarantine or observation, before bringing the local cases to zero and preventing the virus from spreading to other provinces.

In order to compensate by the speed bump caused by the unprecedented Shanghai lockdown, other provinces and cities need to ramp up their investment in infrastructure projects, core industries and high-tech innovations to boost high-quality and sustained economic growth. The four industrial cluster-cities, the southern Great Bay Area centering Shenzhen, the eastern Yangtze Delta Area that was led by Shanghai, the northern Beijing-Tainjin-Hebei Area, and the southwestern Chongqing-Chengdu Area, should spare no efforts to stimulate their economic activities.

Meanwhile, to help millions of market entities, small and medium-size enterprises and the self-employed, to survive the pandemic hit, the policymakers are obligated to provide preferential policies, such as exemptions of more taxes and fees, and fiscal dole-outs to assist them counter the coronavirus induced slow-down .

And, China's central authorities are blessed with low inflation levels in the country which may drive them to come up with more accommodative monetary and fiscal policies to fuel up economic growth. As the world's other major economies, particularly the US and the EU, suffer from elevated inflation of 7-8 percent or more, price rises in China have been kept at around 2 percent, which enables the central bank to maintain a lower interest rate for 2022, and the country's enterprises to enjoy inexpensive lending costs to expand their businesses.

The author is an editor with the Global Times. bizopinion@globaltimes.com.cn