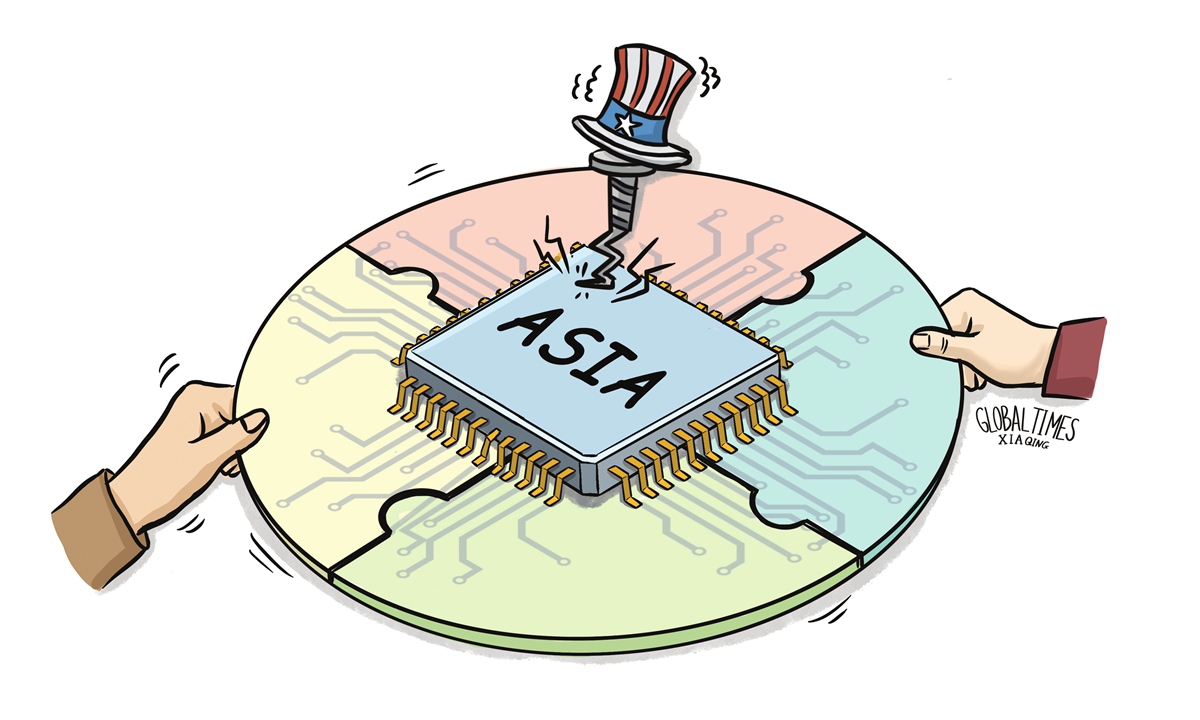

Illustration: Xia Qing/Global Times

Tokyo Electron, one of the world's major suppliers of chip making equipment, appears to be very concerned about US moves to broaden restrictions on high-tech exports to China, a crucial market for the Japanese chip gear maker, according to a recent Nikkei report.Amid a global semiconductor industry that is increasingly fragmented by geopolitical hegemony, Tokyo Electron's concern highlights the anxiety of major semiconductor players about how to maintain a balance between the US political pressure and their own operations.

Yet, the Japanese government seems to be shrugging off the growing market concerns, instead preferring to form a chip alliance with the US and showing no hesitation about following the US strategy that apparently aims to exclude China from the high-tech industrial chain. While the US-Japan tech alliance may seem to promise technological gain on the surface, the Japanese semiconductor sector could suffer a fatal blow if Japan really swallows the poison pill of joining the US disruption of a market-driven global industrial chain.

From an industrial perspective, Japan's willingness to strengthen chip cooperation with the US may be derived from concerns about the development and production of its own semiconductor sector. At present, although Japan has an obvious advantage in raw materials and equipment in terms of the industrial chain, it is hard for the domestic industries to achieve major breakthroughs by playing catch-up to competitors in South Korea and China's Taiwan when it comes to the chip manufacturing and design. Therefore, Japan has accepted the "olive branch" offered by the US in the hope that the Japanese semiconductor industry will receive great lifting with the help of American technological strength.

Japan's ambition to recover from the lost three decades is laudable, but following the US' lead in breaking up the industrial chain is not a shortcut, but a dead end. If Japan joins the US in blocking China from the semiconductor industrial chain, it is to cut off with its economic and trade relations with China, and the Japanese economy will likely fall into the abyss.

The US gambit to establish a chip alliance is not just about building an industrial chain or supply chain that excludes China's presence and suppresses China's technological and manufacturing development, but also about consolidating its own dominant position in determining the global semiconductor development. Indeed, the US suppression and containment faced by the Chinese semiconductor sector may be reminiscent of the semiconductor industrial friction between the US and Japan decades ago. The nature of American political ugliness in taking any means necessary to curb the rise of emerging semiconductor powers and to protect its own industrial interests has never changed.

In the late 1980s, Japanese semiconductor manufacturers once swept the global market by taking the lion's share of more than 50 percent. Nevertheless, since Japan was then portrayed as America's greatest economic threat, the US pressured the Japanese semiconductor sector in an all-round approach through imposing anti-dumping tariffs as well as trade sanctions, signing the US-Japan Semiconductor Agreement, and supporting the South Korean industry. As a result, Japan's semiconductor sector lost momentum and entered the so-called lost three decades.

The lessons of the past may still be relevant today. While it is unclear whether the US will tighten high-tech export controls to China or roll out any other targeting policies, one thing is clear that if Japan loses its independence in cooperation with the US and becomes a tool used by the US in achieving its industrial dominance, Japan's goal of upgrading its domestic industry will fail and a huge loss could be incurred. This is because during the process of US pressuring China, Japan's industrial interests are often the easiest to be sacrificed.

Take Tokyo Electron as an example. There is every reason for the company to be anxious. With the growing risk of a global recession, demand is expected to shrink. If their China business is affected due to US pressure, that would be a serious blow to their bottom line. What's more, given the past precedent, it is even possible that American competitor could grab their Chinese market share by applying for exemptions.

In this sense, Japan is advised to not just see the superficial interests in the chip alliance with the US, but to see the poison behind the temptation.