Illustration: Chen Xia/GT

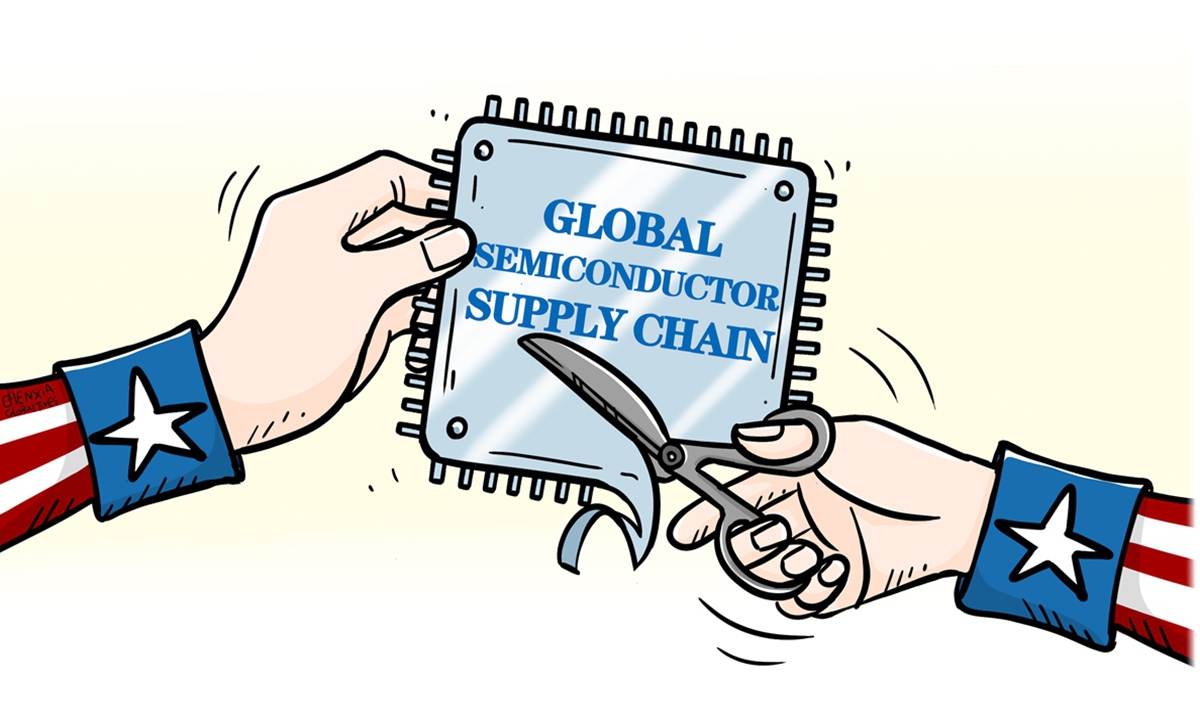

The US, Mexico, and Canada on Tuesday pledged to ramp up the development of semiconductor supply chains in North America, according to an official document released by the White House after the 2023 North American Leaders' Summit. The White House said that the region will in early 2023 organize the first-ever trilateral semiconductor forum with the industry being asked to adapt government policies and increase investment in semiconductor supply chains across North America.While the attempt to strengthen cooperation over semiconductor output in North America may appear to consolidate the US control over the global semiconductor sector, efforts to reshape the industrial chain could only lead to industrial fragmentation, rather than improving supply chain resilience at a time when countries have all attached rising importance to securing their own chip supplies.

There is no doubt that the idea of boosting North America semiconductor industrial chain is led by the US, which is "America First-driven." Canada and Mexico are nothing but subordinates in the US-dominated supply chain. Everyone is clear that they don't really have a say on the issue, just like they don't have much leverage in the United States-Mexico-Canada Agreement (USMCA), which substituted the North America Free Trade Agreement.

At a time when chips are viewed as central to the struggle for supremacy in space, artificial intelligence, electric vehicles and other strategically important industries, the US has attached more geopolitical elements to the semiconductor supply chain, which it wants to put on its watch. This is Washington's motive behind promoting the regional chip supply chain in North America.

The question is that with so many geopolitical considerations, would the chip industry really develop exactly as the US wishes? In the case of the North American supply chain, will the US support enable Mexico and Canada to build up a manufacturing system that can rival the current industrial chain dominated by Asia? And who on earth will provide tens of billions of dollars to invest in the regional semiconductor industrial chain that lacks talent and technology?

It may not be very hard to conclude that Washington's persistent attempts to restructure the global industrial chains in the name of the so-called values-based alliance or guise will only make doing business increasingly difficult.

The US earlier proposed the so-called Chip 4 alliance with major Asian players, and it also discussed strengthening supply chain cooperation with EU and now, it attempted to step up developing semiconductor industrial chain in North America. All this lays bare the US is eager to dominate the global semiconductor production and supply chain.

However, what Washington has been doing will only make the global semiconductor industry more fragmented, driving up costs, and ruining the whole industry in the end.

The US push for North America chip cooperation has the same purpose as its previous efforts to require rules of origin in manufacturing through the USMCA, which has motivated Chinese and Asian manufacturers to invest in Mexico, extending their industrial chains to Mexico.

Over the past years, bilateral trade between Mexico and the US has grown rapidly, partially due to the trade frictions between China and the US since 2018. It may appear that Mexico has replaced some Chinese exports, such as textiles, to the US.

But Mexican producers have imported a lot of intermediate goods, raw materials and machinery from China. In 2022, Chinese exports to Mexico exceeded $100 billion for the second year in a row, which is the best proof of the close trade ties between the two emerging economies. If Mexico wants to increase its exports to the US, it needs to increase its imports from China. And the same logic may also apply to the chip sector. Mexico needs the support of Chinese suppliers when it comes to building low-end chip production capacity.

Mexico relies heavily on China and Vietnam for low- and medium-end chips, as well as mechanical and electronic products and equipment. Its television, computer and car assembly industries still need large amounts of imported parts. It is not possible for all these manufacturers to move to Mexico. In terms of overall manufacturing competitiveness, Mexico lags far behind China and Southeast Asia.