Semiconductor decoupling push disturbs global supply chain: experts

US' CHIPS Act spurs growing concerns among enterprises

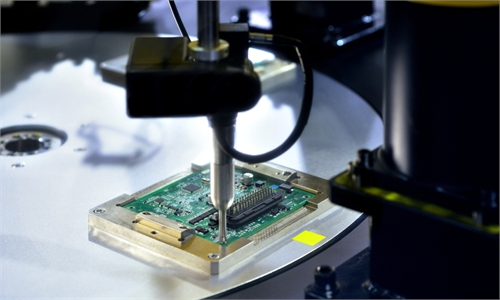

Workers make chips at Anhui Dongke Semiconductor Co in East China's Anhui Province on Saturday. Photo: VCG

Chinese experts on Wednesday decried the latest decoupling push by the US in the chip sector, with Washington asking subsidy recipients under the so-called CHIPS Act to stop expanding chip manufacturing capacity in "foreign countries of concern" for 10 years, which is widely viewed as a move targeting China.

By obsessively targeting China, the US has walked far along the road of hurting others without benefiting itself, while putting the global chip supply chain under severe threat, industry analysts said.

The US Commerce Department on Tuesday released details for accepting subsidy applications from semiconductor makers. The $39 billion program came along with a series of conditions, including investment restrictions in China.

Semiconductor production has undergone a comprehensive globalization process. By attempting to reshape it artificially, the US is recklessly going against basic economic laws, which is to produce very bad consequences, analysts said.

American enterprises and society have had to bear the "bad consequences" from massively layoffs to sharp declines of company revenues, Xiang Ligang, director-general of the Beijing-based Information Consumption Alliance, told the Global Times.

For instance, Intel Corp's revenue came in at only $14 billion in the fourth quarter of 2022, down 32 percent year-on-year; and its full-year revenue last year totaled $63.1 billion, down 20 percent year-on-year.

Qualcomm also reported lower-than-expected revenues. In the quarter ended December 25, 2022, the company reported net income of $2.24 billion, down 34 percent from the previous year.

Allies of the US could not avoid the fallout of the nefarious meddling of the US in disrupting global supply chains, Xiang said.

Dutch chip-gear giant ASML Holding has been coerced by Washington, and its CEO Peter Wennink complained in an interview that the company has "given up enough" with the pre-existing restrictions on its sales to China, according to Bloomberg.

However, US chip-gear makers would benefit from that restriction as more than 25 percent of ASML's revenue comes from China, whereas the country accounts for 15 percent of its sales, Wennink said.

It is no news for the US to follow the principle of "America First" and reap benefits from its allies without hesitation, Ma Jihua, a veteran industry analyst, told the Global Times.

The US reportedly reached agreements with the Netherlands and Japan to tighten export restrictions against China. The South Korean government has been trying to negotiate with the US, seeking to protect South Korean chipmakers' current investments in China from the CHIPS Act, media reports said.

For the first time in almost 30 years, South Korea recorded a trade deficit with China in May 2022. Xiang noted that a prime reason was that Chinese chipmakers ramped up efforts to promote import substitution of China's memory chips.

"The act will seriously disrupt the previously efficient global value chain, while making everyone insecure and distrustful of each other," Ma said, noting that it will be a tough task for the US to cultivate its own production chains under such circumstances.

While the Biden administration seems to have huge ambitions for the CHIPS Act, the latest application details, which were mixed with a series of "unexpected conditions," sparked concerns domestically, according to media reports.

It requires companies that want subsidies to share future excess profits with the US federal government and provide childcare for employees, and it prohibits applicants from using the funds for dividends or stock buybacks.

Citing anonymous industry insiders, Reuters reported that "some unexpected provisions make the funds less attractive" and "this is going to cause heartburn for companies."

Since the whole CHIPS Act goes against economic rules, Washington has to repeatedly come up with attached conditions to 'plug the loopholes' so as to promote the implementation of the act. It will slow down companies' business development and the government will lose its credibility among enterprises, Ma said.

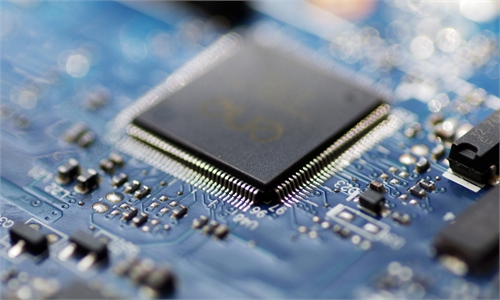

Chinese chip enterprises have achieved rapid growth in recent years despite the crackdown by the US and its decoupling push, analysts said.

China has remained the world's largest semiconductor market for many years. SMIC, for example, recorded revenue of $7.2 billion in 2022, up 34 percent from the previous year, despite the crackdown by the US.

The momentum was also observed in the global market share of the Chinese chipmakers. Just six years ago, China's semiconductor sales were $13 billion, accounting for only 3.8 percent of global chip sales. In 2020, however, the Chinese semiconductor industry accounted for 9 percent of the global market, according to an SIA analysis.

China's chip self-sufficiency drive has also made huge leaps. It is estimated that China's chip self-sufficiency rate jumped from 5 percent in 2018 to 17 percent at the end of 2022, and it will break 25 percent in 2023, Xiang said.

China's industrial and information development is facing a more severe and complex external environment amid the escalating US crackdown. However, it is a key hurdle that China must scale in advancing new industrialization, wrote Minister of Industry and Information Technology Jin Zhuanglong.

The ministry on Wednesday said that China will boost efforts to control supply chains in key industrial sectors and make breakthroughs in key technologies, including comprehensively promoting 6G research and development.