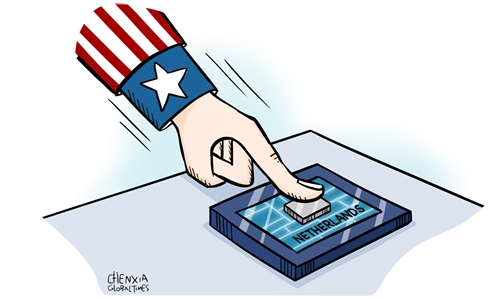

Illustration: Chen Xia/GT

The US' "decoupling" push against China in the semiconductor sector has seen major semiconductor manufacturing regions successively roll out their own plans to invest billions in their domestic semiconductor industries, which not only plunges the global supply chain into greater volatility and uncertainty but also leads to huge waste of resources.The latest example is the EU, which on Tuesday agreed on a final version of a 43 billion euro ($47 billion) plan that aims to double the bloc's share of global chip output to 20 percent by 2030, according to Reuters.

The EU plan, on the surface, points to an attempt to reduce its dependency on Asian suppliers, but it may also serve as further proof of the intensified fragmentation of the global semiconductor industrial chain. The EU is not the only region that has introduced legislation to boost support for its domestic semiconductor industry. In late March, South Korea just passed a bill to boost the country's semiconductor industry by giving companies tax breaks to spur investment. The US and Japan have also rolled out similar subsidy plans to encourage their domestic semiconductor manufacturing.

It seems that the competition among global chip manufacturers is bound to become increasingly fierce in the foreseeable future as countries and regions are eyeing to strengthen and build up their own manufacturing capacity to secure their own supply chains. But such development apparently runs counter to the globalization trend of the semiconductor industry.

After decades of development, the semiconductor sector has already become an industry that needs close industrial and supply chain collaboration worldwide. The US, Europe, Japan, South Korea, the Chinese mainland, and the island of Taiwan have all occupied important positions on the global semiconductor supply chain in terms of manufacturing equipment, materials, production, and market.

But now the US attempt to cut China off the existing global chip supply chain and strengthen its control over the chip manufacturing has already raised widespread vigilance and concern among impacted economies. On one hand, there is growing awareness among economies that their interests are being hurt by the US weaponization of the chip industrial chain against China. On the other hand, they also worry about the possibility of being marginalized by a US-dominated semiconductor supply chain system that has been proved essential to the modern digital economy.

If these regions were to produce at home the chips they need, that would not only create more uncertainty and turmoil in the global supply chain, but also lead to overcapacity. Indeed, recent plunge in profits seen across chip giants like Samsung is already telling enough about the consequences of excessive capacity.

To a certain extent, the US' "decoupling" push has sown the seeds of fragmentation of global industrial chain, which is bound to bring fiercer competition and run huge losses.

For China, the intensified fragmentation of global semiconductor industrial chain will undoubtedly put greater external pressure on the Chinese manufacturing.

Yet, there is no way for China's chip industry to passively wait for others to "decoupling" from it. Instead, China's chip industry needs to strengthen technological breakthroughs to break the US blockade and containment.

In the meantime, however, the deepening cracks in the global industrial chain may also provide opportunities for China to cooperate with other technologically advanced regions. This is because China's position as the world's largest chip market will not change in the near term, and China is also the largest supplier of intermediate goods, which determines that the EU, Japan, South Korea and other economies cannot afford to be completely cut off from China.

Take the EU. What the EU needs now is to reduce and avoid risks, not cutting itself off from China, which is not in line with the bloc's fundamental interests. European Commission President Ursula von der Leyen on Tuesday said that "We can - and we must - carve out our own distinct European approach that also leaves space for us to cooperate with other partners, too."

The EU's strategy of developing chip industry shows that it wants to establish its own independent chip technology system, not to become a vassal of the US industrial chain.

The possibility of cooperation between China and the EU in the chip sector has not been completely ruled out. The key is that China and the EU must find new ways to cooperate under the US' "decoupling" pressure.