OPPO’s shuttering chip design unit not to impact nation’s overall efforts to achieve tech self-reliance

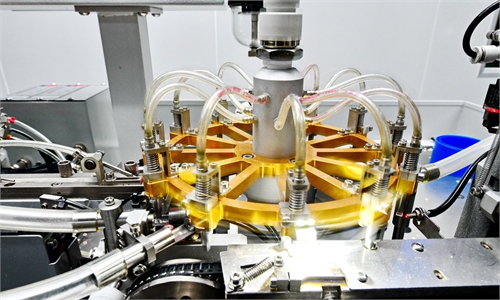

Workers are overseeing chips manufacturing at a local semiconductor plant in Ganzhou, East China's Jiangxi Province on March 28 2022. Photo: VCG

China's leading smartphone maker OPPO will shut down its chip design unit Zeku amid rising uncertainties in the global economy and the smartphone market, the company announced on Friday.

While the case itself is an indication of the obstacles faced by Chinese chip manufacturers, industry analysts said that OPPO's termination of its chip design section is unlikely to cast cloud over the country's overall semiconductor sector.

Established in 2019, OPPO set up the wholly-owned chip design subsidiary with some 3,000 employees, covering businesses including the research, development, production, and sales of semiconductors, and the product lines range from basic application processors, to 5G modems among other products, according to publicly available information released by the company.

OPPO announced it would terminate all Zeku employee contracts as of Friday, May 12, through an internal memorandum, and the laid-off workers will have access to compensations, according to a report by Chinese news site stcn.com.

An industry insider who asked to remain anonymous told the Global Times on Sunday that other companies have opened channels to absorb terminated Zeku employees.

OPPO said that it decided to stop Zeku operation following careful consideration of the market conditions, as the company is facing uncertainties from the global economy and mobile phone industry, noting that it will handle related matters accordingly, and continue to make good products and create value as always.

Lingering challenges

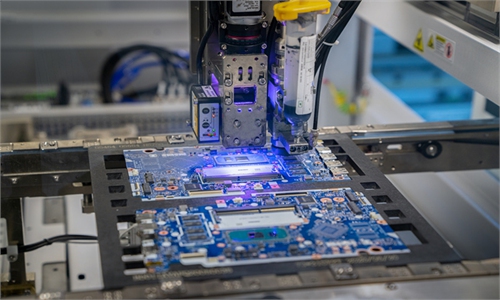

In 2021, OPPO unveiled MariSilicon X product -- its first self-designed imaging neural processing unit built on 6-nm process technology, aimed at improving images for video and photography taken on smartphones, which are used in some of OPPO's flagship phone models.

However, designing a chip and the chip's actual entry to the market are two completely different situations, with more labor and operational costs and investment to be added, according to a report by a Shanghai-based industry researcher ICwise.

OPPO invested significantly in Zeku, but it has remained far from mass production amid a relatively sluggish industry environment, analysts said, adding that OPPO basically generates revenue through phone sales, and the decline in market demand for smartphones in recent years makes it more difficult to support large investment.

OPPO announced in 2020 it would invest 50 billion yuan ($7.19 billion) into technology research and development (R&D) over the coming three years including in chip design and production, and as a result, the company's R&D investment in 2019 rose to 10 billion yuan from less than 4 billion yuan in 2018, the report from stcn.com noted.

Industrial data showed that global smartphone shipments in 2022 reached 1.21 billion handsets, a year-on-year decrease of 11.3 percent. OPPO's shipments in 2022 recorded a year-on-year drop of 22.7 percent to 100 million sets, accounting for 8.6 percent of the global market share.

OPPO, as a smartphone manufacturer, usually purchases chips from the market or invests in own chip companies which is a relatively mature business model, Xiang Ligang, director-general of the Beijing-based Information Consumption Alliance, told the Global Times on Sunday, adding that the use of self-made chips might result in market fluctuation risks.

In addition, US' reckless attempt to impose strict restrictions on technology export to China in its bid to contain China's economic rise, also led to OPPO's decision to call off Zeku.

ICwise also noted that geopolitical tensions can't be neglected. Zeku's two previous chips also adopted the 6-nm process technology from TSMC, and the company's reportedly next phone processor will be adopting TSMC's 4-nm technology, which is now under the ban issued by the US government.

Necessary transition

Despite the difficulties, industry analysts continue to be positive of the future development of China's chip sector on top of the country's unique advantages and human resources strength, in addition to the Chinese government's strong support.

The termination of a chip firm does not entail serious trouble in China's chip industry at all, but it's a necessary path of industrial transformation, optimization and consolidation, Xiang noted.

Xiang added that the industry has entered a fast transitioning phase with Chinese enterprises adjusting, merging, and consolidating to form stronger clusters to lead to higher-quality products.

China has seen huge funding flow to the development of the chip industry, which experts believe is necessary to promote the industry to achieve more qualitative changes in the coming months, Ma Jihua, a veteran technology analyst, told the Global Times on Sunday.

Data from Chinese analytical firm CINNO Research showed that China invested a total of 1.5 trillion yuan in semiconductor-related projects in 2022, which significantly backs up the nation's independence and capability in the semiconductor field.

Xiang noted that the number of semiconductor enterprises in China surged from thousands to tens of thousands with a large amount of capital pouring into the sector, indicating that talent and technology rather than investment, is what is in tight supply.

A Shenzhen-based venture capital company told the Global Times on Sunday that the whole semiconductor industry from designing, manufacturing to packaging has been a heated investment option since 2018, even during the COVID-19 pandemic, and it is looking forward to semiconductor firms in Shanghai, Nanjing, Shenzhen and other cities making good progresses in the past two years.

Ma said that China's globally leading manufacturing ability along with progressing development for semiconductor equipment and talent cultivation are advancing in tandem, which are premium advantages backing the sector's continuous development.

Taking China's automobile industry as an example, China's electric vehicle industry has achieved a major leap through the vigorous development of electric batteries, while the nation was previously unable to break through the bottleneck of internal combustion engines, Ma said, expecting the chip industry will usher in a turnaround following the introduction of new materials and new technologies.

Chinese provinces and cities have been making strategic moves to support the development of local chip sectors and related industries. For instance, Shanghai said it will grant up to 100 million yuan to support eligible projects related to semiconductor manufacturing equipment and materials and other high-end software projects in April.