US President Joe Biden (left) and French President Emmanuel Macron attend the G7 Summit on June 27, 2022 at Elmau Castle, southern Germany.Photo: AFP

The US President Joe Biden decided to curtail his upcoming trip to the Asia-Pacific by canceling a visit to Australia and Papua New Guinea due to the ongoing debt ceiling negotiations in Washington, which, some Chinese experts said reflects that Washington only treats its so-called allies and partners as chess pieces and instrument, and when its domestic issues override its political agenda, it easily turns back on its commitment.

Meanwhile, a planned summit of Quad leaders in Sydney next week has been scrapped, which will affect US' diplomatic engagement with the Asia Pacific region, some experts said. Given its outstanding debt issue, the US has been facing a continuously declining power and sending out strategic confusion signals, arousing suspicion among its allies over its leadership and reputation, they noted.

Karine Jean-Pierre, White House Press Secretary, said in a statement on Tuesday that Biden spoke to Australian Prime Minister Anthony Albanese earlier Tuesday "to inform him that he will be postponing his trip to Australia." Biden's team engaged with the Prime Minister of Papua New Guinea's team to inform them as well. And the Biden administration looks forward to "finding other ways to engage with Australia, the Quad, Papua New Guinea and the leaders of the Pacific Islands Forum in the coming year," the statement said.

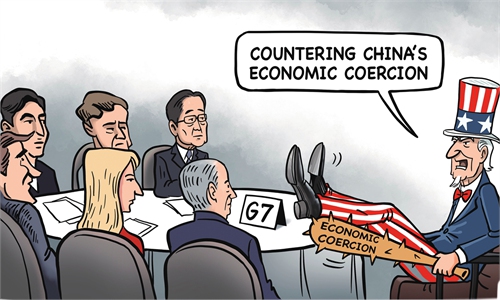

In Sydney, Biden had planned to attend a meeting of the four so-called Quad nations -- the US, Japan, Australia and India, which was formed with a mind toward countering China's rising influence in the Asia-Pacific region, Reuters reported.

And in the PNG capital Port Moresby, Biden was originally due to attend a meeting of the 18-member Pacific Islands Forum, and sign security pacts with the host and with Micronesia, according to media report.

Biden is still scheduled to leave on Wednesday heading to Hiroshima, Japan, to attend a three-day G7 summit and will return to the country on Sunday. Some media reported that US Treasury Department has estimated that the US will go into a crippling default as early as June 1 if Congress does not lift the debt ceiling.

The AP described the "scuttling of two of the three legs of the overseas trip" is a foreign policy setback for an administration that has made putting a greater focus on the Pacific region central to its global outreach.

There has been palpable high expectation for Biden's trip to the two countries, especially the PNG, as some media earlier said "it would have been the first by a sitting US President to a Pacific country and comes as the two nations pursue a security pact."

"It shows that when its own domestic political demands override its international agenda, the US will turn back on its commitment with no hesitation," Chen Hong, director of the Australian Studies Center at East China Normal University, told the Global Times on Wednesday.

The US has been forming such small cliques to counter China's influence in the Asia-Pacific but those countries should realize that their own interests are far more important than being manipulated by the US, especially when the declining US power only makes its strategy of containing China fragile, Chen said.

After the Cold War, the US began to ignore the South Pacific, removing some island embassies, and reducing assistance to the region. Recently, the US has opened a new embassy in Tonga, another country in the Pacific region, to counter China.

After seeing that China and the Pacific region are having more reciprocal cooperation, the US felt "the crisis" and the anxiety, and began wooing Pacific island countries through official visits and exerting political influence, analysts said.

"As the US treats its diplomacy as a bandage to fix ties with some countries, sending out a strategic confusion signal," Chen said.

Eroding confidence

While the US politicians are mired in arguments about settlement of the debt ceiling which might lead to an imminent default in about two weeks, experts noted that this would bring about fluctuations on the global financial markets as well as erode global investors' confidence in US dollar assets in the long run.

According to a BBC report on Wednesday, Biden and Republican leaders have expressed cautious optimism that a deal to raise the US debt ceiling is within reach, but the report also cited House of Representatives Speaker Kevin McCarthy as saying that the two sides are still "far apart."

Liang Haiming, dean of Hainan University's Belt and Road Research Institute, told the Global Times on Wednesday that historically, US bond yields usually surge shortly before the US hits the debt ceiling.

"It's less than half a month before the US hits the debt ceiling this time. The US debt ceiling crisis will undoubtedly affect US dollar credit in the short term, lead to an increase in US bond yields and trigger global financial market turmoil," Liang said.

Liang also noted that the incident might bring a shadow to the G7 summit and weaken other members' viewpoints about the US.

"Those countries might feel that the US is a troublemaker in the international financial market instead of a leader," he said.

Dong Dengxin, director of the Finance and Securities Institute of the Wuhan University of Science and Technology, said that the impact of the incident on financial markets should be more of a long-term nature instead of short-term shockwaves.

"I think it's just a matter of time before US politicians agree on raising the debt ceiling. But such issues will definitely increase people's distrust about the US dollar and prompt them to take measures such as decreasing holdings of US assets, buying gold, renminbi or other non-dollar assets," Dong told the Global Times on Wednesday, adding that the process of "quantitative change" is already taking place, though at a slow pace.

There have been doubts over the US leadership not only in the international financial market but also on geopolitical landscape. Although the Quad leaders still plan to meet on the G7 sidelines in Japan, the canceled Quad meeting in Australia will surely affect such mechanism, especially when there have been divergences between the US and Australia over the AUKUS deal.

"It will surely affect the US' diplomatic engagement with the Asia Pacific. When the US woos its so-called allies and partners in the region, those countries would question whether the US policies have continuity or it would turn back on its commitment, doubting its leadership," Li Haidong, a professor at the Institute of International Relations at the China Foreign Affairs University, told the Global Times on Wednesday.