2023 Yearender: China forges ahead against relentless US crackdown; technology breakthroughs accelerate

Production of semiconductor chip File photo: VCG

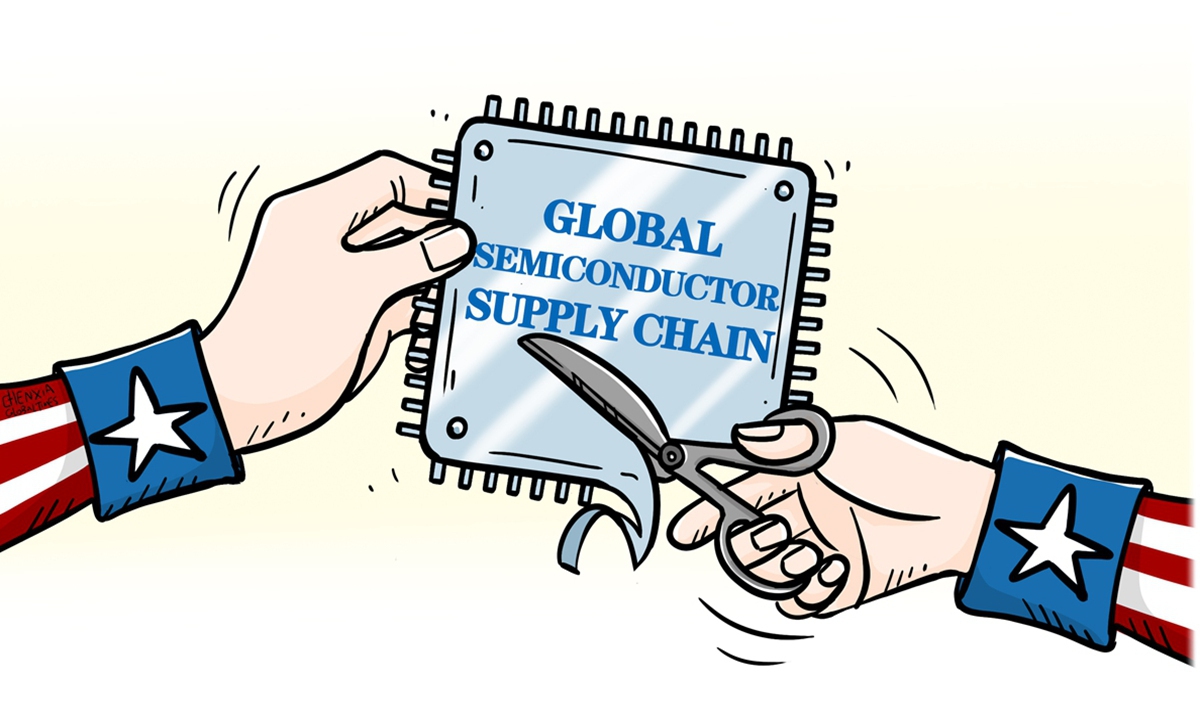

As if the world isn't grappling with enough crises, from geopolitical conflicts to a global economic slowdown, 2023 has emerged as another year characterized by relentless US unilateralism and protectionism, with a dizzying number of crackdown measures designed to further disrupt global supply chains.

However, the defining story of 2023 lies in the resurgence of Chinese technological prowess. It stands as a testament that, even under the relentless onslaught of the US' most formidable blows, Chinese high-tech firms have not only weathered the storm but have emerged even stronger, showcasing extraordinary resilience.

It is still too soon to say that China has won the "chip war," but there's no doubt that a string of breakthroughs the nation has made has already shattered the effectiveness of the US' blockade. China's resilience has prompted Washington policymakers to question the objective behind US sanctions: Are they meant to restrain or encourage Chinese innovation?

The technology developments were "deeply concerning," US Commerce Secretary Gina Raimondo said in middle December when asked about how the US Department of Commerce would respond to China's recent breakthrough in chip manufacturing.

Raimondo, meanwhile, vowed to take the "strongest action possible" in the year ahead.

Seeking breakthroughs

"If 2023 was marked by concern and confusion, I am cautiously optimistic about the nation's chip industry in 2024," Jason, a 53-year-old senior executive at a chip design company based in East China's Jiangsu Province, told the Global Times on Friday.

"The turning point this year was the surprise launch of Huawei's Mate60 series. We did not expect the breakthrough could be made this soon, it was inspiring and timely," Jason said.

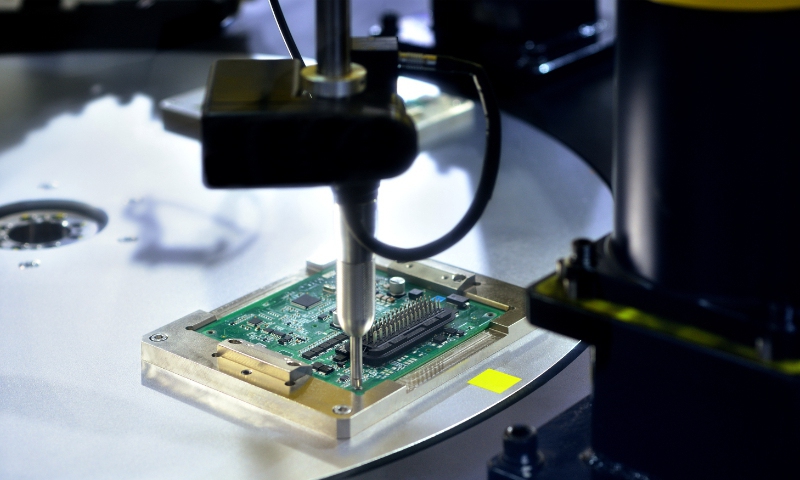

On August 29, the US-sanctioned Huawei unexpectedly announced the launch of its high-end Mate60 smartphone series. The device, believed to incorporate a domestically-made 5G capable chip, soon shocked the world.

"A domestically-made 5G chipset indicates a kind of success in the whole chip-making industrial chain amid cut-off - either its chip design, safe fabrication, or packaging - it's unbelievable the industry has been able to close the gap in such a short amount of time," Jason said.

Huawei has not revealed any details about the chipset, leaving many wondering how the Chinese tech giant is making such strides in the face of extreme technological trade restrictions.

The Global Times has spoken to many industry players close to the matter, most of whom declined to comment, or asked to remain anonymous due to the sensitivity of the topic.

"It's an all-out effort with many involved amid mounting uncertainties. But one thing is for sure - nothing will hold back China's fight to advance in chip technology and tech development, though the fight will be arduous and long," a Shenzhen-based industry player, who asked to remain anonymous, told the Global Times on Sunday.

According to the individual, the self-sufficiency fight started roughly three years ago, dominated by government bodies and several leading industry giants, with a list of smaller suppliers who may have the potential to replace certain "sensitive key components" that were cut off from foreign suppliers.

"These small players on the list will be offered certain support to ramp up that process, but will be kicked out based on the ability of these replacements. Winners will stay as stable suppliers," the individual revealed.

That's a competition of strength, and an opportunity for those small but "powerful" enterprises to grow into a significant factor in reshaping the domestic industrial chain amid the pursuit for technology progress, the insider said, explaining why the US sanctions have become an incentive for the industry to grow at unprecedented speed.

Moreover, as most companies are increasingly inclined to adopt domestic products, a virtuous cycle in the industry has been formed, industry players told the Global Times.

For instance, while an imported chip costs 20 yuan ($2.8), the domestic replacement costs up to 200 yuan. However, even with the higher price, Chinese companies are still choosing to use domestically made chips in order to mitigate market risks. As the demand for homegrown chips continues to rise, their prices will fall and their performance will improve over time, creating a positive feedback loop.

This will ultimately increase China's share in the global market, which was previously dominated by foreign giants.

By 2027, China's share in mature process (28nm and older) capacity is expected to reach 39 percent with room for further growth if equipment procurement proceeds smoothly, TrendForce, a leading market intelligence provider, said in a statement sent to the Global Times.

Huang Renwei, executive vice dean of the Fudan Institute of Belt and Road and Global Governance, said on Saturday at the 2024 Global Times Annual Conference that the US overrates the impact of its strategy of "small yard, high fence" in the field of science and technology, believing that it can block China, but in reality, China has broken the US blockade in certain technological areas, and has achieved breakthroughs.

Huang believes that the fight against this tech blockade will last for at least another decade, and it will take at least 10 years for China to completely break the US blockade.

The building of a modern industrial system through scientific and technological innovation is also at the top of the economic agenda for 2024.

The tone-setting Central Economic Work Conference, held in Beijing from December 12 to 13, highlighted various areas, including the digital economy and artificial intelligence as priorities, drawing the blueprint for guiding the nation forward.

Protectionism backfires

The past year not only witnessed the growth of Chinese tech firms, but also marked a critical time when the US has kidnapped its allies, including Japan and the Netherlands, to join its efforts to contain China's tech sector growth, though it means considerable economic losses for companies in the two countries.

Japan announced in late March a draft revision to a ministry ordinance on its Foreign Exchange and Foreign Trade Act, adding 23 chip-manufacturing items that would require government approval to be exported. The rule took effect on July 23.

The Dutch government announced a ministerial order in late June to restrict exports of certain advanced semiconductor equipment. The export controls came into effect on September 1.

In response to chip shortages and geopolitical influences, fabless customers are diversifying risk by working with multiple foundries, potentially leading to increased IC costs and concerns over duplicate orders. Customers are also requiring global validation of production lines, even with long-term foundry partners, to enable flexible capacity adjustments, TrendForce told the Global Times.

Consequently, foundries must navigate larger scale capacity and price competition while needing to maintain profitability, flexibility in capacity adjustments, new capacity depreciation pressures, and technological leadership, TrendForce said.

However, it appears that these industry struggles are not part of US policymakers' considerations. In October, the Biden administration further tightened restrictions on AI chip exports to China, exacerbating the already broad and harsh crackdowns in place.

The Semiconductor Industry Association, a US chip-industry group, immediately blasted the rules in a written statement. "Overly broad, unilateral controls risk harming the US semiconductor ecosystem without advancing national security as they encourage overseas customers to look elsewhere," the group said.

History tells us that only opening-up and inclusiveness can accelerate technological development, while protectionism will only delay and disrupt US dominance and leadership in the sector, Zhang Hong, a veteran telecom industry analyst, told the Global Times on Friday.

Furthermore, Zhang noted that technological independence does not mean that China will produce everything domestically as chip production requires collaboration with other countries, suggesting China should and will continue to seek cooperation with advocates of globalization.

China has repeatedly made clear its position on US chip export controls targeting China.

The US should stop politicizing, instrumentalizing and weaponizing tech and trade issues as well as stop disrupting global industry and supply chains. China will closely follow these developments and firmly safeguard its rights and interests, Chinese Foreign Ministry spokesperson Mao Ning told a press conference in late November.