Containers pile up at Pyeongtaek Port in Gyeonggi Province, South Korea on July 31, 2025. Photo: VCG

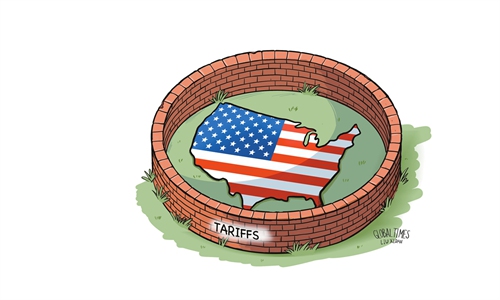

Editor's Note:The US' new tariffs on 69 trading partners are set to take effect on Thursday. The US' new tariffs on 69 trading partners are set to take effect on Thursday. Targeted countries not only include the US' close allies such as Japan and South Korea, but also important emerging economies like Southeast Asian countries. What impact will such high tariffs have on these countries? And what are the broader implications for global trade? The Global Times invited scholars from three of the affected countries to share their perspectives on these pressing questions.

Muhammad Abdurrohim, a research coordinator of ASEAN-China Research Center of Universitas Indonesia

The eventual negotiation reduced the US-imposed tariff on Indonesian exports from an initial 32 percent to 19 percent, but this concession came with significant costs. Notably, the US government required Indonesia to transfer and manage personal data on its soil - a demand that sparked strong public opposition and criticism due to concerns over data vulnerability abroad.

This tariff agreement profoundly impacts Indonesia's export strategy and regional positioning. Under the deal, Indonesia has agreed to eliminate tariffs on more than 99 percent of US goods and purchase over $19 billion worth of American products, including 50 Boeing jets. This asymmetric arrangement compels Indonesia to adjust its trade relationships and fiscal policies to accommodate a surge in American imports while grappling with diminished competitiveness in the US market.

The 19-percent tariff on Indonesian exports fundamentally alters the country's comparative advantages in key sectors including palm oil, textiles and manufactured goods. Consequently, Indonesia is driven toward deeper regional integration to hedge against US market volatility. Many scholars recommend that Indonesia counterbalance these tariff pressures by strengthening trade relations and regional cooperation, particularly through agreements with major partners.

This episode illustrates the fragmentation of the multilateral trading system into more bilateral, transactional relationships. US demands demonstrate the limited options available to middle powers under hegemonic economic pressure. This precedent encourages other emerging economies to diversify their trade partnerships and bolster South-South cooperation.

The US approach signals a shift from rules-based trade toward power-based economic diplomacy, potentially accelerating the formation of alternative trade blocs and regional frameworks. For Indonesia, this means balancing immediate economic pragmatism with long-term strategic autonomy through diversified partnerships and enhanced regional integration.

Ko Ko, a well-known media personality and chairman of Yangon Media Group in Myanmar, and chairman of the Myanmar Narrative Think Tank

The US tariff on Myanmar has increased anxiety among the public and businesses in the country. Although it is understood that the tariff policy is part of a broader global strategy applied by the US administration and is not specifically targeted at Myanmar, there is still considerable surprise at the consideration of imposing such high tariff rates.

High tariff rate increases can have a significant impact on Myanmar's economy. Most of Myanmar's exports to the US are from Cut-Make-Pack (CMP) garment factories. The garment industry in Myanmar employs approximately 800,000 workers, most of whom are young, less-educated women from rural and suburban areas. The nature of CMP businesses is that they tend to relocate to places where they can be more profitable. Therefore, if these businesses move to countries with lower costs than Myanmar, many of these workers will become unemployed, severely impacting them and their dependent families.

Furthermore, Myanmar is currently suffering from recent earthquakes and other disasters, and the economy is struggling to survive amid these difficulties. At such a time, this kind of high tariff rate, like adding fuel to the fire, could lead to increased unemployment and, consequently, deeper poverty. Since similar tariff rate increases have been imposed on neighboring countries, there will definitely be an impact on regional trade as well.

Countries might start re-evaluating their trading partners, shifting from traditional, long-standing relationships to those based on political alignment, national security and economic nationalism. There's a concern that global traditional supply chains could be disrupted, leading to global economic instability, widening development gaps and even trade-based political conflicts. Trump's tariff storm won't just increase costs; it could fundamentally alter the architecture of global trade. Therefore, it is difficult to say that we will not see trade-based cold wars instead of politically-motivated ones, as we saw in the past.

Jaewoo Choo, professor of Chinese foreign policy, Department of Chinese Studies, Kyung Hee University

The US trade and tariff deal, cutting reciprocal tariffs from 25 percent to 15 percent, is contentious, primarily because the Korean government views the deals differently to the US. For instance, the presidential office sought to downplay remarks by US Secretary of Commerce Howard Lutnick that "90 percent of the profits" from Korea's investment into the US will go to the American people, saying it understood the figure as part of a "reinvestment concept."

But the US side presents a completely different narrative. US President claimed that South Korea "will give to the United States $350 Billion Dollars for Investments owned and controlled by the United States, and selected by myself, as President."He predicted greater Korean investment. He also said South Korea will "invest a large sum of money for their investment purposes," It was following Trump's social media post that US Commerce Secretary Lutnick wrote on X that "90 percent of the profits" will be "going to the American people." They both claimed Korean investment earnings belong to America.

Even more problematic is that Korean firms have no say in where they invest. In South Korea, the deal has been considered unequal - where one party loses not only profit but also control over its own capital. The upcoming summit between Lee Jae-myung and the US side is again expected to revolve around financial matters. Defense and military issues may not be addressed as anticipated.

Instead, the US seems intent on subordinating Korea economically, turning it into a platform for American manufacturing interests. Korea is expected to become self-sufficient in funding US-based investments. The Korean government must urgently reform this unfair arrangement to protect its companies.

Moreover, the US' coercive approach to "friendly shoring" may prove unsustainable. Demanding that allies bolster the US manufacturing base is fundamentally flawed for one reason: businesses operate for profit. Without guarantees of corporate returns, the strategy risks backfiring. Empty promises without assurances hold little value. As a result, companies may choose to bypass coercive friendly shoring and instead diversify their trade and investment partnerships.