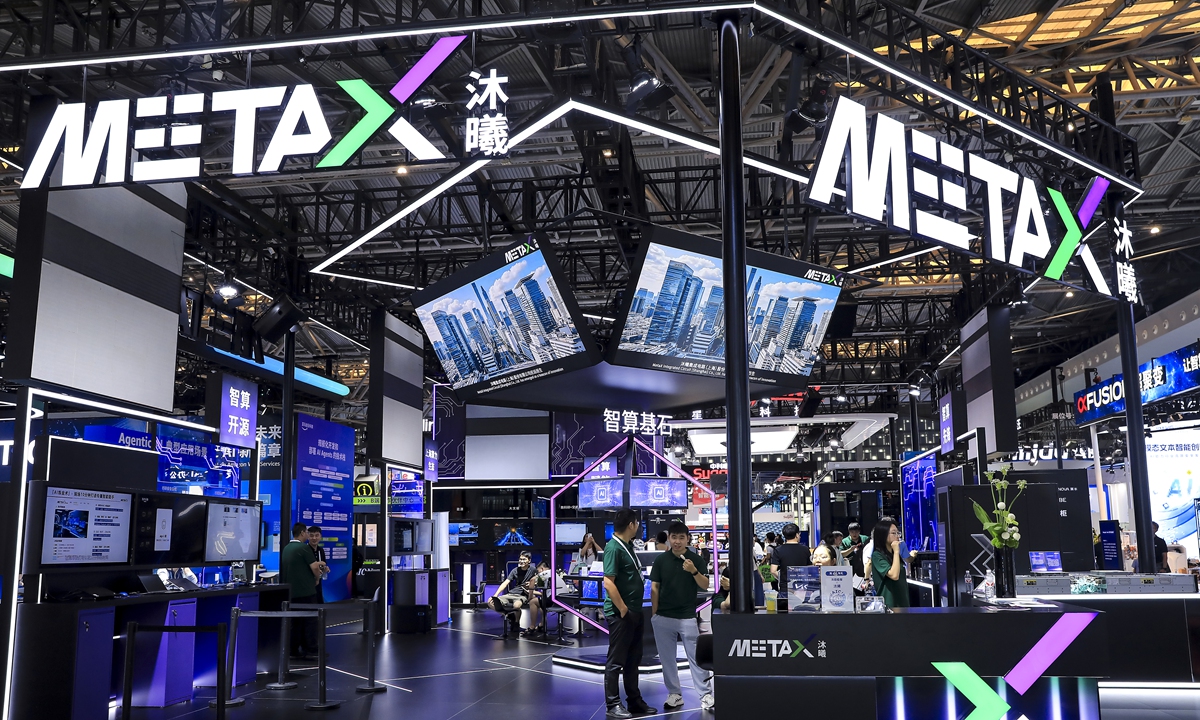

A booth of MetaX during World Artificial Intelligence Conference 2025 in Shanghai on July 29, 2025. Photo: VCG

China's another GPU maker, MetaX, debuted at the STAR Market of the Shanghai Stock Exchange on Wednesday. By the close of the trading on Wednesday, the company's share price surged by 692.95 percent, closing at 829.9 yuan ($117.85) per share, pushing the company's market capitalization to nearly 332 billion yuan.

According to Xinhua Finance, MetaX is one of the leading companies in China's high-performance general-purpose GPU sector. The company priced its IPO at 104.66 yuan per share, making it the second-highest issue price among new listings on the STAR Market this year, just behind Moore Threads' 114.28 yuan per share.

The proceeds from the IPO will be used to fund the research, development, and industrialization of next-generation high-performance general-purpose GPUs; the development and industrialization of a new generation of AI inference GPUs; and R&D projects for high-performance GPUs targeting cutting-edge fields and emerging application scenarios, according to the report.

According to the company's previous announcement on the online subscription status and lottery rate for the IPO, a total of 5.1752 million investor accounts participated in the online subscription for its new shares, surpassing the 4.8266 million for Moore Threads. After the callback mechanism was activated, the final online lottery rate stayed at 0.033 percent, the report said.

On December 5, Moore Threads surged by 425 percent to reach 600.5 yuan per share on its first trading day on the STAR board of the Shanghai Stock Exchange. The company's IPO generated huge interest, with its shares being oversubscribed more than 4,000 times by retail investors.

China's technology unicorn Biren Technology received approval on Monday from the China Securities Regulatory Commission for a listing at the Hong Kong stock market, the Securities Times reported on Tuesday. The company plans to issue up to 372.458 million ordinary shares and list them on the Hong Kong Stock Exchange, potentially becoming the "first GPU stock" in the Hong Kong Stock Exchange.

Industry analysts said the surge in the companies' shares highlights investors' confidence in the growth potential embedded in China's push for GPU independence and the opportunities of the domestic industry.

"Growing capital inflows into companies like Moore Threads will help them gain momentum in multiple aspects including research and development capabilities and market influence, and eventually, this will be transformed into industrial capacity and innovative products," Xiang Ligang, director-general of the Beijing-based Information Consumption Alliance, told the Global Times.

According to data from the China Commercial Industry Research Institute, China's GPU market size is expected to reach 107.3 billion yuan in 2024, up 32.96 percent year-on-year. However, China's GPU industry still lags behind certain developed markets. With strong government support and the continued maturation of key technologies across the Chinese AI industry chain, the process of domestic GPU substitution is expected to accelerate, the National Business Daily reported.

Global Times