Chinese automakers speed up integration into global market

Move contributes to local industrial chains, economic growth: expert

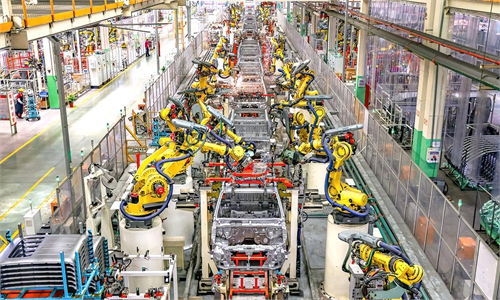

This photo taken on Nov. 3, 2025 shows a new energy vehicle (NEV) assembly line of BYD, China's leading NEV manufacturer, at the plant of BYD in Zhengzhou, central China's Henan Province. Photo: Xinhua

Chinese auto enterprises continued to expand overseas in 2025, while actively integrating into local supply and production chains in the new year, with BYD, China's leading new-energy vehicle (NEV) manufacturer, serving as the latest example, as the company reportedly became the fastest-growing Chinese brand in Ecuador last year with its pure electric cars.

In 2025, BYD sold 2,916 vehicles, up 243.1 percent year-on-year, in the South American country, Ecuadorian media outlet El Universo reported on Wednesday (local time), citing figures from the Association of Automotive Companies of Ecuador.

According to the association, GWM, Chery, Dongfeng, Sinotruk and Foton were among the top 20 in vehicle sales for 2025 in the nation, the report said.

Bloomberg reported on Tuesday that BYD outsold Tesla in Europe's two largest electric vehicle (EV) markets last year. In Germany, Europe's biggest EV market, the Chinese company's car sales surged eightfold to 23,306, while Tesla's fell by nearly half to 19,390. BYD also outperformed Tesla in the UK.

In 2025, BYD's overseas sales reached 1.049 million units, up 145 percent year-on-year. In December alone, sales hit 132,000 units, demonstrating strong momentum in overseas sales, according to a report BYD sent to the Global Times on Thursday.

The company has also actively built factories overseas to better meet local market demand. "The factories that have been completed are in Uzbekistan, Thailand and Brazil, while those under construction are in Hungary and Cambodia," BYD told the Global Times.

In addition to BYD, other Chinese auto brands have moved to integrate into overseas supply and production chains in the new year.

China's Dongfeng Motor is in talks with an investor about producing passenger cars in Turkey, Reuters reported on Thursday, citing the company's Turkish distributor. Chinese car manufacturers including Chery have been seeking to set up production facilities with local partners, it said.

Nikkei Asia said that Chery will open its largest factory in Southeast Asia in Vietnam in 2026, with total investment of up to $800 million and full capacity of 200,000 cars annually.

Li Auto, after establishing a presence in Uzbekistan, has officially entered the markets of Egypt, Kazakhstan and Azerbaijan. This move signifies that the brand has completed its key market expansion across Central Asia, the Caucasus and Africa, CCTV reported.

"With fast technological progress, cost-performance ratios, and prominent strengths in intelligence and electrification, Chinese car companies are seeing rapid sales growth in overseas markets, marking a widespread trend," Cui Dongshu, secretary-general of the China Passenger Car Association, told the Global Times on Thursday.

Cui noted that Chinese automakers' going global strategy is gradually shifting from mere product exports to a deeper integration into local industrial ecosystems, including manufacturing, supply chains and service systems.

"This trend not only helps enhance the long-term competitiveness of Chinese brands in local markets, but also positively drives the improvement of industrial chains, job creation and economic growth in the relevant countries," the expert said.

Nikkei Asia reported on December 30 that Chinese carmakers are estimated to have taken the top position in global new vehicle sales for the first time in 2025, surpassing Japanese players, which held the position for more than 20 years but were set to drop to second place.

Global sales of Chinese vehicles rose about 17 percent year-on-year to about 27 million units in 2024. In comparison, worldwide sales for Japanese automakers likely remained flat at just under 25 million units, according to Nikkei Asia. The publication noted that this means China, after becoming the world's top car exporter in 2023, is on track to take the top spot in overall sales in 2025.

Cui said that the impressive performance of China's automotive industry overseas fundamentally reflects the overall strength of the country's manufacturing system. China possesses the world's most complete and highly collaborative industrial system, and the development of its automotive industry is fully drawing on and absorbing the mature experience of other manufacturing sectors in going global, the expert said.

"Chinese automakers not only provide overseas markets with high-quality, affordable, and technologically advanced products, but also offer new options and references for local industrial development and consumption upgrades. They are exerting an increasingly significant influence on the global automotive industry landscape," Cui noted.