Japan reportedly to begin deep-sea rare earth mud extraction trial; Chinese expert says project viability faces prohibitive costs and slim prospects

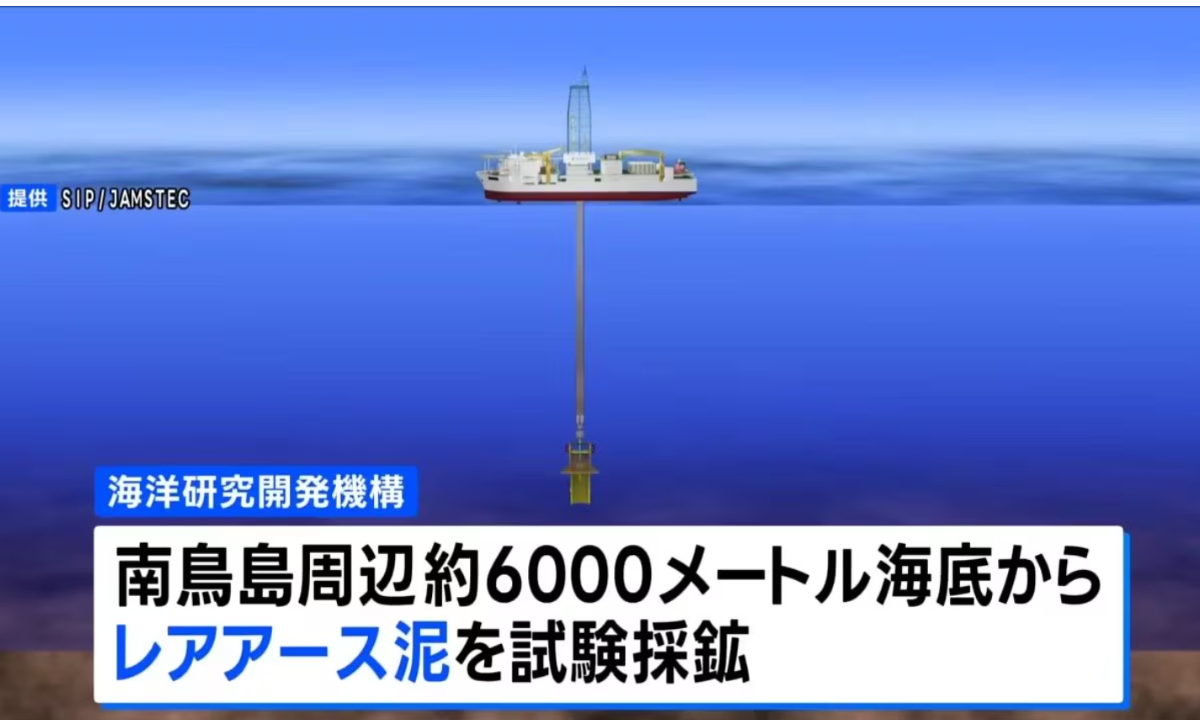

Japan's deep-sea drilling vessel Photo: Screenshot of a TBS report

Japan is set to launch the world's first experimental extraction of so-called "rare earth mud" within its exclusive economic zone on Sunday, according to multiple Japanese media reports. The Japanese side has attempted to portray the move as a first step toward industrializing domestically sourced rare earths, but experts in both Japan and China have cast doubt on its commercial viability.

A Chinese expert pointed out that formidable technical barriers, prohibitive costs, an uncertain path from pilot tests to large-scale production, and escalating geopolitical risks are likely to add to difficulties to Japan's bid to find alternative rare earth sources, adding that Tokyo's increasingly erroneous positions on China-related issues could further intensify supply strains and economic pressures.

The mission, under the SIP Ocean program, will use a deep-sea drilling vessel to test deep-sea mining operations, lowering equipment to about 6,000 meters below the surface in waters near within Japan's exclusive economic zone and confirming that the system functions as intended on the seabed, according to a press release by the Japan Agency for Marine-Earth Science and Technology (JAMSTEC) issued in December last year.

According to the release, the trial is scheduled to run from Sunday to February 14, 2026, and is the world's first such experiment conducted at a depth of around 6,000 meters. However, Nikkei.com reported on Friday that the departure had been postponed to the morning of Monday due to weather conditions and other factors.

Deep-sea rare earth development faces fundamental technical constraints, prohibitive costs and limited prospects for success, said Da Zhigang, director of the Institute of Northeast Asian Studies at the Heilongjiang Provincial Academy of Social Sciences. He noted that operations at depths of more than 6,000 meters must withstand extreme pressure and complex ocean currents, while core processes such as seabed extraction and material lifting remain technologically immature.

Of particular note, global rare earth refining and processing capacity is highly concentrated in China. "This means that even if Japan succeeds in extracting raw materials, it would still face heavy reliance on external processing systems," Da told the Global Times on Sunday.

Moreover, the expert noted that deep-sea mining entails extremely high costs, and the transition from experimental extraction to large-scale commercial use is expected to be protracted. "Compared with direct imports from overseas, the economic viability and supply-chain stability of such operations remain markedly weaker," Da added.

Japanese media outlet has also voiced concerns. A January 5 episode of MBS Television's Yonchan TV noted that the seabed mining plan continues to face numerous obstacles to commercialization, including technical feasibility, extractable volumes and costs. The report citing a professor from University of Tokyo said that Japan's annual demand for rare earths stands at around 18,000 tons. To meet that level of demand, millions of tons of sediment would need to be mined each year after accounting for concentration levels.

As early as 2019, an academic report archived by Yamaguchi University in Japan shows that deep-sea mining requires massive upfront investment. It said that developing seafloor hydrothermal deposits could result in losses of 83.4 billion yen ($ 550 million) over a 20-year period, while even rare-earth mud - considered relatively simpler to extract - would, based on 2013 estimates, take around 16 years to recoup roughly 75 billion yen in equipment investment.

"The plan remains highly uncertain and cannot yet be regarded as a reliable strategic safeguard," said Da.

Japan relies on China for about 60 percent of its imports, according to Reuters. For some heavy rare earths, such as those used in magnets for electric and hybrid vehicle motors, Japan is almost entirely dependent on China, Reuters reported on Wednesday, citing analysts.

China's Ministry of Commerce (MOFCOM) announced on Tuesday a decision to tighten export controls on dual-use items destined for Japan, citing national security and non-proliferation obligations. The move followed recent erroneous remarks by the Japanese Prime Minister Sanae Takaichi regarding China's Taiwan region, hinting at the possibility of military intervention in the Taiwan Straits.

A MOFCOM spokesperson on Thursday criticized Japan's erroneous stance and its push toward "remilitarization," saying such actions challenge the post-war international order and are bound to undermine regional peace and stability, endangering world peace and security. The spokesperson stressed that China's measures are aimed at curbing attempts at "remilitarization" and nuclear armament and are fully legitimate, reasonable and lawful.

Amid its attempt to secure rare earth supplies, Japan is trying to step up outreach to its Group of Seven partners. Finance Minister Satsuki Katayama said she will meet counterparts from other industrialized democracies to discuss critical minerals during a trip to the US starting Sunday, while Defense Minister Shinjiro Koizumi is also set to hold talks with his US counterpart on Thursday, according to a Bloomberg report on Saturday.

Da said that so-called G7 agreements on critical minerals amount more to strategic signaling than to binding supply guarantees. "Other G7 countries, including the US, face their own rare earth supply bottlenecks, and internal divisions further limit the effectiveness of such cooperation, making it difficult to substantially ease Japan's supply challenges in the short term."

Da noted that instead of seriously addressing the root causes of tensions, the Japanese government has responded to China's legitimate countermeasures with tough rhetoric, using it to cover high-risk political opportunism. He warned that Japan is moving further down the wrong path and "should not underestimate China's resolve to safeguard its core interests."

Chinese Ambassador to Japan Wu Jianghao has rebuffed a démarche lodged by Japan's Vice Minister for Foreign Affairs Funakoshi Takehiro over China's strengthened export controls on dual-use items to Japan. Wu stressed that the measure aims to "safeguard national security and interests and fulfills international non-proliferation obligations. It is entirely justified, reasonable and lawful." China's position has been made clear and China will proceed with relevant measures as planned, the ambassador noted.