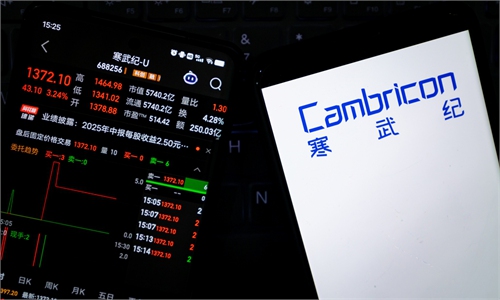

Cambricon ranks 1st on Hurun’s 2025 China AI list with 630 billion yuan market capitalization

Cambricon Photo: VCG

Chinese artificial intelligence (AI) chip designer Cambricon ranked first on the 2025 Hurun China AI Enterprises Top 50 list, which was released on Monday, with a valuation of 630 billion yuan ($88 billion), as AI chipmakers emerged as the highest-valued segment in China's rapidly growing AI sector.

The valuation of Cambricon surged 165 percent from a year earlier, according to the report released by the Hurun Research Institute, the Global Times learned from the institute.

Second on the list was Moore Threads, often described as China's first domestically listed GPU maker, with a valuation of 310 billion yuan. It was followed by MetaX, one of China's earliest high-end GPU developers to achieve full domestic production, valued at 250 billion yuan.

AI chip-related companies dominated the ranking. Seven of the top 10 firms are from the AI chip sector.

The concentration highlights the central role of computing hardware in enabling large-language AI models and industrial applications. Analysts said that it reflects rising momentum in domestic computing capabilities as China advances efforts to strengthen technological self-reliance.

According to a press release that the company sent to the Global Times, 14 computing-power hardware companies made the list this year, up nine from last year, with Cambricon standing out among them.

Founded in 2016, Cambricon focuses on the development of core AI processor chips and is China's first publicly listed AI chip company. Its revenue in the first three quarters of last year surged more than 23-fold year-on-year, highlighting strong growth momentum for the country's leading domestic AI chipmaker, according to media reports.

Several major AI application companies also ranked among the top 10, including speech recognition firm iFLYTEK, computer vision company SenseTime, and multimodal generative AI start-up MiniMax, according to the release.

The ranking shows rapid expansion and turnover across the sector. A total of 18 companies are new entrants this year, accounting for more than one-third of the list, with 10 of them coming from the AI chip industry.

Geographically, companies based in Beijing and Shanghai account for 60 percent of those on the list, while more than 80 percent are located in first-tier cities. Analysts attributed this pattern to the concentration of talent, research institutions, capital and industrial resources in major urban centers.

The report also noted that listed companies have shown strong innovation momentum, with the average founding year being 2014. The youngest companies on the list are Moonshot AI, Baichuan AI, and StepFun, all founded in 2023 and focused on large-language AI models.

Overall, the ranking shows that China's AI development is moving toward a stronger focus on core hardware and computing power, as expanding applications place higher demand on long-term technological foundations, analysts said.

Rupert Hoogewerf, chairman and chief researcher of the Hurun Group, said in a statement sent to the Global Times that China's position in the global AI landscape strengthened markedly in 2025.

"At the end of 2024, Chinese open-source models accounted for as little as 1.2 percent of the global market at their lowest point, before rising sharply to nearly 30 percent at their peak," he said.

While a gap remains compared with leading international computing-power players, the difference is expected to narrow significantly over the next five years as China's computing industry accelerates breakthroughs, according to the chairman.

The 2025 Hurun China Top 50 AI Enterprises ranks companies by valuation, with listed firms valued based on their market capitalization as of January 9, 2026, and unlisted firms assessed by reference to comparable listed peers or their latest financing rounds. This marks the second time the Hurun Research Institute has released the ranking.