GT Voice: Co-op with Asian industrial chain vital to South Korea’s continued chip growth

Illustration: Chen Xia/Global Times

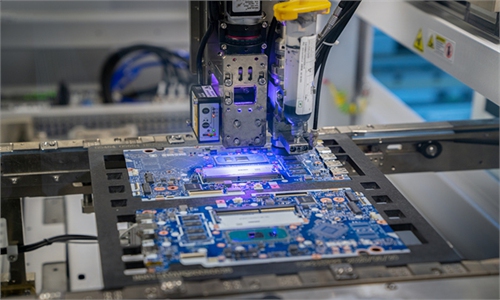

South Korea's semiconductor exports have shown continued strong growth in the early weeks of 2026, lifting overall exports. Exports of semiconductors, the country's top export item, surged 70.2 percent year-on-year, accounting for 29.5 percent of total exports in the first 20 days of this month, the Securities Times reported on Thursday, citing official data.Despite ongoing global economic uncertainty, South Korea's semiconductor industry sustained its expansion in 2025, driven by advances in artificial intelligence (AI). This sustained momentum underscores the vital role played by high‑tech industries in South Korea's export‑oriented economy.

Yet, South Korea's semiconductor exports also face multiple challenges. Tariff pressure, technological export controls and other measures by some countries still pose potential risks to the sector. Global trade seems likely to continue experiencing significant turbulence in 2026.

Just last week, the US imposed a 25 percent tariff on imports of certain AI chips under a new national security order, according to Reuters. While South Korea's trade minister reportedly suggested that the US move may only have a limited impact on South Korean companies, uncertainty is on the rise within the semiconductor sector globally, especially considering that the US appears to intensify pressure over semiconductor tariffs.

For instance, US Commerce Secretary Howard Lutnick claimed on January 16 that South Korean memory chipmakers that aren't investing in the US may face up to 100 percent tariffs unless they commit to increased production on American soil, Bloomberg reported. Such a policy signal undoubtedly adds uncertainty to South Korea's highly export-oriented semiconductor industry.

In this context, maintaining the growth momentum of semiconductor exports will require South Korea to pursue both technological upgrading and industrial chain collaboration.

On the one hand, South Korea needs to continuously invest in research and development, promote technological iteration, consolidate its competitiveness in high-tech fields, and expand into higher value-added areas such as advanced process nodes. Only by enhancing its technological capabilities can it remain competitive in the fierce market competition.

On the other hand, deepening integration into the Asian semiconductor supply chain and actively aligning with regional industry development needs are crucial for broadening export markets and reducing exposure to protectionist risks.

Asia is the largest trader and manufacturer of chips in most electronic devices. Once chips are assembled with other electronic parts, Asia accounts for 73 percent of global exports of electronics and electric equipment, such as mobile devices, computers, and broadcasting equipment, according to a report by McKinsey Global Institute in 2023.

China and South Korea enjoy strong, complementary cooperation across the semiconductor industrial chain and in trade, offering significant potential for further growth. Strengthening this partnership could drive innovation, boost supply chain resilience, and create new opportunities for both countries.

With annual bilateral trade exceeding $300 billion, semiconductors account for a substantial proportion. Rising Chinese demand for DRAM and NAND flash memory has strongly boosted South Korean chipmakers. Continued collaboration amid the AI boom in the semiconductor sector could unlock even greater growth opportunities for both countries.

Now with the rapid development of AI, new-energy vehicles, and industrial intelligence across the region, demand for semiconductor products within Asia will continue to grow. By strengthening collaboration with other Asian countries like China and by leveraging China's vast end-product manufacturing market, South Korea can contribute to a more resilient regional industrial network, which would not only expand market opportunities but also diversify trade partnerships, thereby helping to withstand the effects of trade protectionism.

For Asia's semiconductor industry as a whole, facing restructuring global technology competition and trade patterns, there is a shared need to promote innovation and regional cooperation. By continuously optimizing the industrial division of labor, the region can transform the individual strengths of its economies into collective competitiveness, enabling Asia to seize the development opportunities of the AI era together.