GT Voice: Investment, collaboration both crucial to South Korea's chip competitiveness

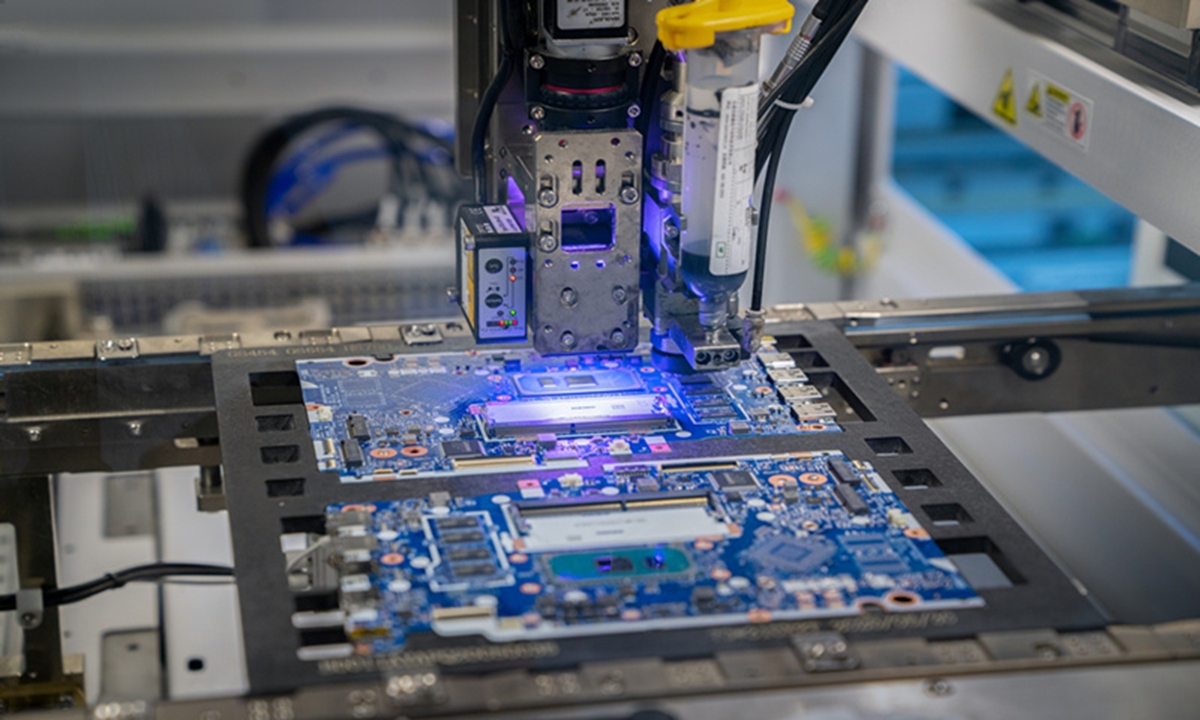

A chip manufacture machine Photo: VCG

SK Hynix said on Tuesday that it has decided to invest 19 trillion won ($12.9 billion) to build an advanced chip packaging plant in South Korea to meet rising memory chip demand related to artificial intelligence (AI), Reuters reported. According to a company statement, the construction of the new factory will begin in April, with completion targeted by the end of next year.This move makes SK Hynix the latest South Korean chipmaker to unveil a major expansion plan. Previously, Samsung Electronics said that it would add a chip production line at its plant in the South Korean city of Pyeongtaek to meet rising demand amid the global boom in AI, as part of the parent group's 450 trillion won in domestic investments over the next five years, according to a separate Reuters report.

These developments underscore the commitment of South Korea's leading semiconductor companies to strengthen their competitive positions in an intensifying global chip race. Demand for advanced-node chips is experiencing explosive growth, driven by the computing power requirements of AI. South Korean firms' decision to ramp up investment at this critical moment represents both a strategic push to capture leadership in AI and an essential step toward achieving economies of scale.

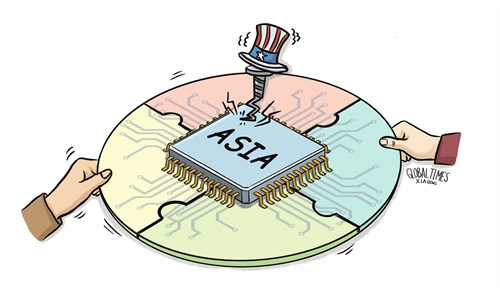

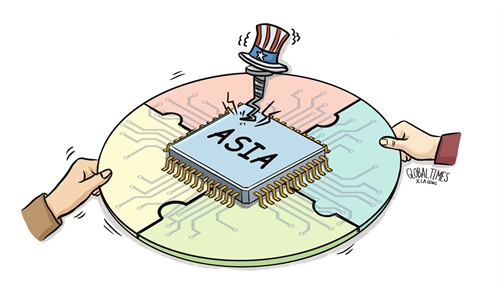

However, the nature of the semiconductor industry determines that no single country or region can establish a completely self-sufficient and closed-loop industrial chain in this sector.

The semiconductor production process, ranging from materials, equipment, design, and manufacturing to packaging and testing, involves numerous links and is highly technology-intensive. Its supply chain has long been deeply globalized, forming a highly collaborative and efficiently coordinated industrial network, particularly in East Asia.

Within this network, the Chinese market plays an especially critical role for South Korea's chip industry. China is not only one of the largest export destinations for South Korean chips, providing stable revenue streams and economies of scale for companies such as Samsung and SK Hynix, but it also serves as a global manufacturing base for key end-products such as consumer electronics, industrial equipment, and data centers.

China's vast manufacturing ecosystem generates sustained and massive demand for chips, which in turn acts as a crucial market force driving continued research and development (R&D) and capacity investment by South Korean chipmakers.

Moreover, China has established relatively comprehensive capabilities in the mid-to-downstream segments of the semiconductor supply chain, including packaging and testing, module assembly, and end-product manufacturing. This creates a complementary relationship with South Korea's strengths in upstream production. Such deep industrial interdependence means that the competitiveness of South Korea's chip industry is closely linked to the efficiency of its supply chain collaboration with China.

It is undeniable that shifts in the global geopolitical landscape are introducing new complexities and uncertainties into international cooperation in the semiconductor sector. In this context, while South Korean companies aim to maintain their leadership in areas such as memory chips and actively expand into emerging fields such as advanced packaging and AI chips through sustained R&D and manufacturing investment, a more pragmatic and long-term perspective to maintain and deepen cooperative relationships with key global markets and industrial chain partners, including China, is also necessary.

This is not merely a commercial consideration for maintaining market share but a strategic necessity for participating in open innovation, retaining technological acuity, and optimizing production capacity layout.

The development of next-generation information technologies such as AI, autonomous driving, and the Internet of Things will place higher demands on chip computing power, energy efficiency, and integration. As the technological race and ecosystem competition within the semiconductor industry intensify, the importance of cooperation and collaboration is likely to grow rather than diminish.

If South Korea's chip sector can strengthen its core competitiveness while more actively participating in and promoting open cooperation within the East Asian and global semiconductor industries - particularly by engaging in constructive collaboration with China and other relevant parties in areas such as joint R&D and building supply chain resilience- it will be better positioned to achieve the dual objectives of technological leadership and market success.

After all, in a globalized industrial system, true competitiveness stems not just from one's own technological barriers but also from the ability to become an indispensable and cooperative node within a network of mutual interdependence.