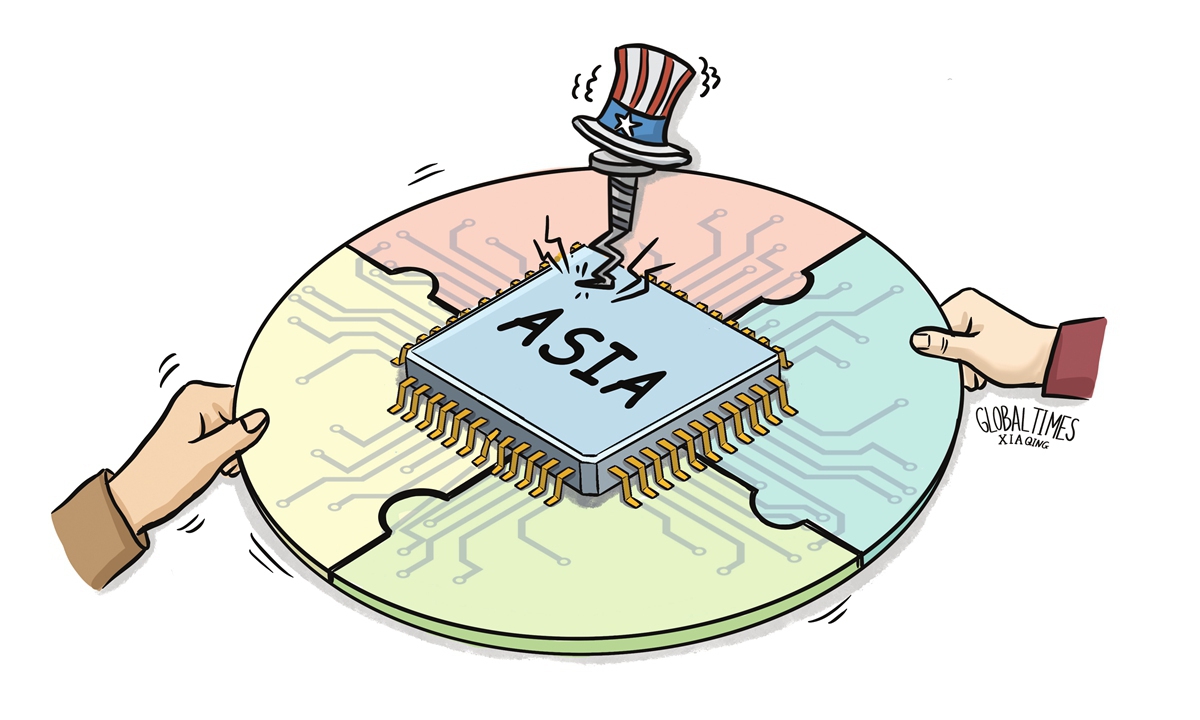

Illustration: Xia Qing/Global Times

The US asked South Korea to urge its chipmakers not to fill any market gap in China if Beijing bans memory chipmaker Micron Technology from selling chips, the Financial Times (FT) reported on Sunday. Its attempt to force South Korean chipmakers to share the losses American companies suffered in the Chinese market is an apparent act of bullying full of arrogance.Neither the two governments nor the related companies have made any comment on the FT report, maybe because the timing is quite delicate: South Korean President Yoon Suk-yeol kicked off a state visit to the US on Monday. The news, to a certain extent, underscores the awkward situation facing South Korea's chip manufacturing sector given the increasingly squeezed room for development under the US hegemony and bullying.

Since the leaders of South Korea's two chip giants - Samsung Electronics Executive Chairman Lee Jae-yong and SK Chairman Chey Tae-won - are among the 122-member business delegation accompanying Yoon during the visit to the US, it will be intriguing to see whether they can strive for more maneuver room for their semiconductor business through the trip.

It is no secret that South Korea's chip manufacturing sector is facing great pressure. Recently, Samsung reported operating profits of 600 billion won ($455 million) in the first quarter of 2023, down 95.8 percent year-on-year and marking a 14-year low, amid cooling demand for memory chips and sluggish business performance.

SK hynix has been no better off. The world's second-largest maker of memory chips is scheduled to report its first-quarter earnings on Wednesday. Analysts said it is expected to see a net loss of 3.14 trillion won, according to marketwatch.com.

The performance slump indicates that the market space for South Korea's chip manufacturing sector has been squeezed by various factors. For starters, demand for everything from smartphones to personal computers has subdued amid fears of a global recession, leading to a sharp fall in both the price and demand of memory chips.

Moreover, US' efforts to block semiconductor industrial chain cooperation between China and South Korea may also have worsened South Korean chip enterprises' situation. In order to contain China's technological development, the US has imposed a series of export controls on semiconductor products and technologies to China and has been putting pressure on its allies and major Asian chipmakers to join its export bans.

For instance, the US has been luring Samsung to build plant in the US on the back of hefty subsidies, but the US CHIPS and Science Act includes a provision that bans companies from receiving US subsidies and tax credits in chip investments from engaging in advanced chip facility investment in China or any other foreign country of concern for 10 years.

If South Korea's chip manufacturing sector was completely under the US' control and served the US' strategy of containing China, it would only lead to the weakening competitiveness of South Korean chipmakers. After all, China remains the largest market for the global semiconductor industry. Without sufficient market demand, it would be useless to subsidize chipmakers to build additional production capacity, which only leads to excessive capacity and waste of resources.

If chipmakers don't want to face fiercer competition in the low- and mid-end chip market, they need to make breakthroughs in advanced manufacturing technology so as to win more market space through technological advantages. At present, this may be the only way for South Korean chipmakers to pull through the current difficulties, but this option still needs to undergo huge challenges. For instance, last year, Samsung announced the start of mass production of chips using its 3-nanometer process nod. While Samsung's 3 nm production came earlier than TSMC's 3 nm, its yield is much lower compared with TSMC's yield, according to industrial reports.

If South Korean chipmakers cannot win the technology race, then it may face the fate of completely becoming the vassal of the US, with even less market space to survive left.

What the US has done with South Korean enterprises is a typical practice of technological bullying and trade protectionism. This is by no means how a country should treat its allies. The reality is that the US has never taken the interests of its allies seriously but often coerces them to serve US interests at the cost of their own interests.