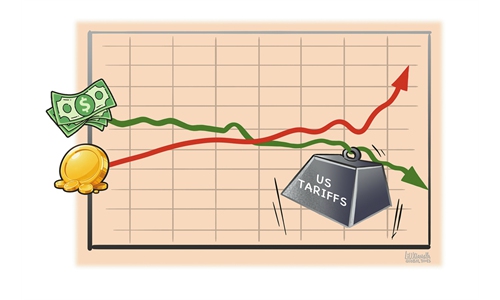

Chinese banks warn of precious metal price volatility as gold, silver extend sell-off after last week’s plunge

Customers inside the Laopu Gold Co store at IFC Mall in Hong Kong on December 25, 2025 Photo: VCG

Multiple Chinese commercial banks issued notices on Monday for investors to guard against price volatility in the precious metals market, as gold and silver extended their sell-off following a recent plunge late last week.

An analyst said the logic supporting gold prices remains unchanged, but prices are unlikely to rise as rapidly as they did in early 2026 after last week's market correction.

Recently, volatility in the international precious metals market has increased significantly, triggering wild sell-offs on the global market. It is advised that investors maintain a rational investment mindset and avoid blindly chasing rallies or selling into dips, based on a prudent assessment of personal risk tolerance, the Industrial and Commercial Bank of China wrote in a notice seen on its website on Monday.

And, the Bank of China reminded its clients engaged in precious metals-related businesses take precautions against growing market risks.

Also, four other large banks, including the Agricultural Bank of China, China Construction Bank, Postal Savings Bank of China, and the Bank of Communications announced adjustments to gold-related businesses and reminded investors of ongoing trading risks.

At around 1:30 pm on Monday, spot gold fell 3.98 percent, while silver plunged as much as 8.63 percent during Asian trading hours.

"The marked fluctuations in global gold and silver prices are primarily due to sudden shifts in macroeconomic expectations, heightened speculative sentiment, and a technically fragile price structure," Zhou Yinghao, a senior gold analyst at the Bank of Urumqi, told the Global Times on Monday.

The surge in precious metal prices since the start of 2026 was driven by sentiment and leverage rather than steady demand growth. Before last week's plunge, the Relative Strength Index - a momentum oscillator that measures how fast and how strongly prices are moving - for gold and silver had remained in the "overbought" territory, and gold and silver prices soared rapidly in the short term, leading to an extremely fragile market structure, Zhou said, noting that the plunge represents a forced correction following irrational market volatility.

On Monday, the Shanghai Gold Exchange issued a notice on adjusting the margin rate and price limit for silver deferred contracts.

"All members are requested to ramp up risk awareness, make detailed risk contingency plans, advise investors to strengthen risk prevention, reasonably control positions, invest rationally, and ensure stable and healthy market operation," the exchange noted in a statement seen on its website.

Heraeus Precious Metals, a leading global precious metals company, projected in December that the price of precious metals in 2026 would reposition and consolidate following such a prolonged period of price surges. The company forecast an average gold price range of between $3,750 and $5,000 per ounce this year, according to a note sent to the Global Times.

"Thanks to strong central bank demand and a favorable macroeconomic environment, gold is expected to remain the most solidly supported. Silver's performance may be more volatile due to industrial headwinds," the company said.

After the technical correction in the precious metals market, the prices of gold and silver are expected to rebound this year, though the growth rate is unlikely to be as rapid as seen during the first several trading days of this year, Zhao Qingming, a Beijing-based veteran financial expert, told the Global Times on Monday.

"The factors supporting the growth of gold remain unchanged," Zhao said, referring to rising geopolitical tensions, global central banks' increased gold holdings, and excess liquidity across international financial markets.