US official’s claim that Chinese traders are to blame for gold price swings ‘groundless’: analyst

Gold File photo: VCG

US Treasury Secretary Scott Bessent cited Chinese traders as a reason for last week's wild swings in the gold market, according to Bloomberg on Monday. Chinese analysts said that the claim is groundless and it was concern about relevant US policies that fueled market volatility.

Asked about the abrupt reversal of a record-breaking rally in precious metals last week, Bessent asserted that "the gold move thing — things have gotten a little unruly in China." He further claimed that "they're having to tighten margin requirements. So gold looks to me kind of like a classical, speculative blowoff."

Hu Qimu, a deputy secretary-general of the Forum 50 for Digital-Real Economies Integration, told the Global Times on Monday that global exchanges, including the Chicago Mercantile Exchange (CME), routinely raise margin requirements as a standard risk-control measure during periods of volatility - not a practice unique to China.

On Friday, the CME Group raised the margin requirements on gold and silver contracts for the third time since January 13, citing high volatility, according to Yahoo Finance.

"To understand the root cause of this round of sharp gold price declines, one must first trace the reasons for the earlier surge. Previously, a weak US dollar combined with global geopolitical tensions drove strong safe-haven demand, pushing gold prices sharply higher," said Hu.

On January 29, international gold and silver prices reached record highs amid strong safe-haven demand. Spot gold hit $5,594.82 per ounce on that day, making January the best month since the 1980s, according to Reuters.

Bloomberg noted on Monday that the record-breaking rally was fueled by speculative buying, geopolitical turmoil and concern about the Federal Reserve's independence.

"The US Treasury Secretary's claim is groundless," Tu Yonghong, a professor at the International Monetary Institute at Renmin University of China, told the Global Times on Monday, noting that the fundamental driver of both the gold rally and its volatility lies in the US dollar itself.

"Since 2025, the US Dollar Index has remained persistently weak, while strong market expectations of Fed rate cuts created abundant global liquidity. As a natural alternative to the dollar, gold attracted buying from central banks and international capital - a textbook market reaction consistent with economic principles," said Tu.

According to the World Gold Council, the gold price reached a record high on January 29 and fell significantly on the following trading days - January 30 and February 2.

Price fluctuations also became more pronounced after news leaked that US President Donald Trump would appoint former Federal Reserve official Kevin Warsh as the head of the US central bank on January 30, a Euronews report said.

"The recent plunge primarily reflected the market's intense reaction to expectations of a 'hawkish' Federal Reserve under a new US Fed chair who reportedly favors high interest rates and balance sheet reduction," said Hu.

A CNBC report also noted that news of Warsh's nomination sent the US dollar soaring.

"The surge of the US Dollar Index after the new Fed chair was announced drove capital out of gold as the opportunity cost of holding non-yielding assets rose sharply," Yang Delong, chief economist at Shenzhen-based First Seafront Fund, told the Global Times on Monday.

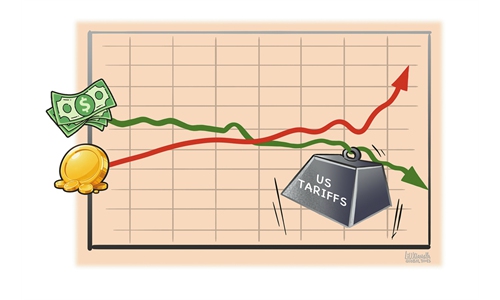

Tu also pointed to the classic "seesaw" relationship between gold prices and the US dollar: when the US dollar weakens and its credibility erodes, gold tends to rise as a hedge against uncertainty amid global safe-haven demand. "Attributing current market fluctuations to China is neither professional nor objective," Tu noted.

Yang pointed out that from a long-term perspective, the fundamentals for higher gold and silver prices remain unchanged, as erratic policies of the US have further intensified global financial instability. This has accelerated the international sell-off of US Treasury debt and prompted a reallocation toward precious metals such as gold and silver, said Yang.