India has a long way to go to compete with China in semiconductors depsite US support

US' selfish move unlikely to bring much benefit to Indian chip ambitions

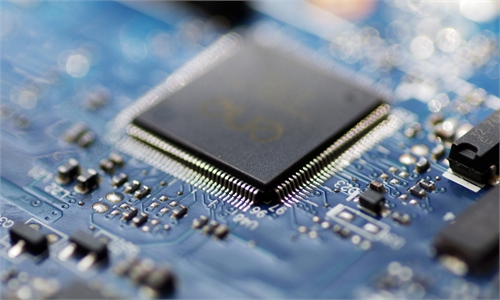

A worker produces chip at a workshop in Suqian, East China's Jiangsu Province, on February 28, 2023. Photo: VCG

While the US just struck a deal with the Netherlands to control chip exports to China, it signed a memorandum of understanding (MOU) with India on semiconductor cooperation in an obvious move to enlist India to join its small, exclusionary circle against China in the global semiconductor industrial and supply chain.

However, experts said the US' top priority is to build up a global chip industrial chain with itself at the core, a move unlikely to benefit India. There is still a long way to go for India to comparatively improve its semiconductor manufacturing capacity to catch up with China, given the South Asian country's weak industrial base, lack of qualified personnel, and poor business environment.

During US Commerce Secretary Gina Raimondo's four-day visit to India, India and the US on Friday signed an MOU, which seeks to establish a semiconductor supply chain and innovation partnership, Reuters reported.

Raimondo said India's ambitions to expand its tech sector are "totally aligned with the US' desire and goal to make our supply chain more resilient, adding that she would announce a number of "substantial investments" by US firms in India, according to the report.

The MOU is an extension of the US plan to strengthen cooperation with its allies in order to hobble China's semiconductor industry and contain China's technological rise, Lou Chunhao, executive director of the Institute of South Asian Studies at the China Institutes of Contemporary International Relations, told the Global Times on Tuesday.

Cooperation with the US may provide opportunities for India to scale up its chip manufacturing, however, India is unlikely to make breakthroughs in core technologies in the sector given its own limits, Lou said, noting: "There is a long way to go for India to develop its semiconductor industry."

Step up efforts in chips

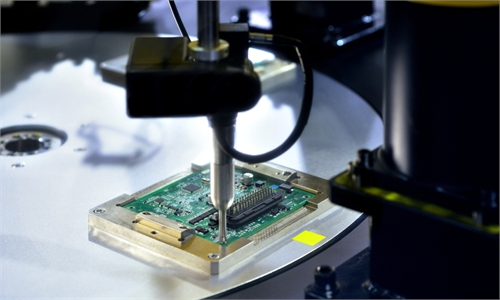

India has almost no semiconductor industry to speak of, other than software-based design. With a rapidly growing demand for electronic products like smartphones and electric vehicles, India is eager to secure a slice of the massive market and has set out its ambition to become a semiconductor manufacturing hub.

India actively introduced a series of policy measures to attract chip companies to invest in production in India. In December 2021, the Indian government unveiled a $10 billion incentive program to provide support of up to 50 percent of the project cost to attract chip makers to set up bases in India.

It's been reported that Indian mining firm Vedanta and Foxconn will invest $19.5 billion in setting up semiconductor and display production plants in Gujarat, India, which is considered an important leap forward for the country's ambitions.

However, semiconductor manufacturing is a globally critical industry that needs close industrial and supply chain cooperation worldwide, and India won't be able to maintain sound growth when the US moves to exclude China and disrupt the stability of the global supply chain, according to experts.

India has some advantages in developing semiconductor industry, including its geopolitical environment and domestic policy support, Lou said. He said India also has abundant chip design talent, accounting for about 20 percent of the global total, and almost all of the world's top 25 chip design firms have research centers in India.

"Despite India's advantages, it's still hard for India to spur the development of a sustainable industrial ecosystem because of the high demand for capital, technologies, and infrastructure," Lou said, noting that stable supply of water, electricity, and skilled workers are among the biggest problems.

China's irremovale place

Although India aims to turn the US' tech war against China to its own advantage to accelerate domestic chip manufacturing development, experts said it's hard for India to replace China in the global semiconductor industrial and supply chain because of China's resilience on the back of massive market demand, sufficient capital, and talent supply.

The Chinese mainland is the world's largest market for chip products. Analysis by London-based data and analytics firm GlobalData showed that China consumes about 40 percent of all the chips made globally and it spent over $400 billion on semiconductor-related imports in 2021, according to media reports.

In contrast, Indian Prime Minister Narendra Modi said in August 2022 that the country's own consumption of semiconductors is expected to surpass $80 billion by 2026 and $110 billion by 2030, Indian news site Business Today reported.

"India's task is how to improve its semiconductor production capacity for domestic use in the short term, rather than supplying the world on a large scale," Fu Liang, an independent tech analyst, told the Global Times on Tuesday.

He said India will not become a threat to China's well-established semiconductor industry in the foreseeable future. "Even though foreign firms have shown a willingness to invest in India's semiconductor sector, they'll probably invest a small amount in low-end products as a pilot," he said. However, China's purpose is to seek technological breakthroughs in higher-end products such as mass production of chips at 14 nanometers or less, he said.

Currently, Chinese companies have been accelerating efforts in making breakthroughs in core technologies. For instance, while Chinese firms used to purchase most front-end defect inspection tools from US firm KLA, which accounts for about half of the global market share, some domestic companies have now released self-developed prototype machines and some have been producing the tool in small quantities, according to experts.